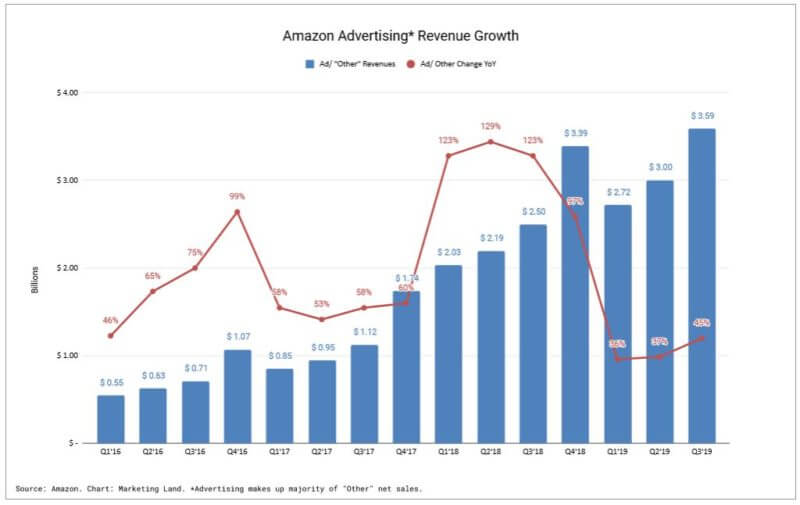

Amazon advertising revenues hit a new high in the third quarter, reaching $3.6 billion. Overall, the company reported lower-than-expected profits of $2.1 billion on $70 billion in revenue for the third quarter of the year on Thursday.

Amazon doesn’t break out advertising revenue, but advertising makes up the majority of an “Other” revenue category in its earnings reports. The other category grew by 45% year-over-year, but the advertising segment of that category actually grew at a rate higher than 45%, Amazon CFO Brian Olsavsky said on the earnings call.

Why we should care. Amazon’s advertising growth rate underscores the threat it is presenting to Google and Facebook in attracting ad dollars from brands and merchants. The company has been steadily investing in solutions for branding and performance advertising including inventory, ad formats and targeting capabilities.

“[W]hat we’re focused on really at this point is relevancy,” said Olsavsky, “making sure that the ads are relevant to our customers, helpful to our customers, and to do that, we use machine learning, and that’s helping us to drive better, better and better relevancy.”

On Fire TV, video and OTT advertising options. “You know one of our areas of focus is expanding our video and OTT offerings for brands,” said Dave Fildes, director of investor relations.

While performance advertising comprises the bulk of budgets going to Amazon, brand awareness campaigns accounted for 42% of spend on Amazon’s DSP in the third quarter, up from just 26% in the first quarter of the year, performance agency Tinuiti reported this week. Spend on Amazon DSP increased 30% in the third quarter, among Tinuti clients, up from 27% in Q2.

“It’s still early in this space, but we’ve done a few things with IMDb TV, Live Sports, things like adding more inventory through Fire TV apps, and as I said IMDb TV, adding more OTT video supply through Amazon Publisher Services or APS integrations and streamlining access for third-party apps and really just making it easier for advertisers to manage their campaigns and provide better results.”

Free one-day shipping costs add up. Amazon has been investing heavily in one-day shipping — more than two billion dollars so far — and is expected to spend $1.5 billion on it in the fourth quarter alone. This type of investment puts a dent in profitability and makes investors skittish, but long-term investments like this make up a well-worn page in the Amazon playbook. Amazon customers have already ordered “billions of items with free one-day delivery this year,” Jeff Bezos, Amazon founder and CEO in a statement.

“Customers love the transition of Prime from two days to one day — they’ve already ordered billions of items with free one-day delivery this year. It’s a big investment, and it’s the right long-term decision for customers.” Bezos also said that the proximity of the distribution centers to customers for one-day means carbon emissions are lower than for air or long-haul delivery routes.

On the shorter holiday season. The company said it does not expect much negative impact from this year’s shorter holiday season — six days shorter than last year, which was the longest possible at 32 days between Thanksgiving and Christmas.

“What we found in the past is that there is generally a holiday budget that is spent somewhere between November 15 and December 25, and well certainly Black Friday and Cyber Monday are important dates in that holiday period,” said Olsavsky.

The company is optimistic it will have its best holiday season ever with the combination of factors such as faster shipping options and its new lineup of Alexa-enabled devices.

This article originally appeared on Marketing Land.

http://feeds.searchengineland.com/~r/searchengineland/~3/3FajwCBCxOw/amazon-ad-revenue-tops-3-5-billion-in-third-quarter-expecting-strong-holiday-season-323988