For many kids in the U.S., this year’s back-to-school season will be marked by a return to video lessons and at-home instruction, not classrooms. And as reliable back-to-school advertisers prepare for a very different academic year, they are also spending a lot less on advertising.

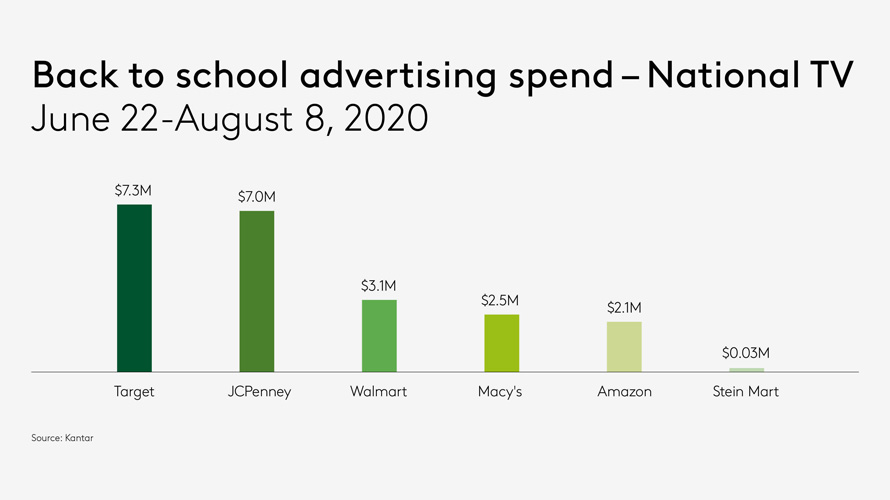

Back-to-school advertising spend is down 70% so far this season compared to the same time last year, according to new data from Kantar, which measures national TV ad spend. Retailers have spent $23 million on back-to-school ads on national TV from June 22 through Aug. 8, compared to $76 million a year ago.

The drop in back-to-school advertising is just one of several challenges that networks are facing as ever-shifting marketer needs have translated to a rocky and considerably depressed ad marketplace. First-quarter ad revenues earlier this year were down across the board for networks as they felt the effects of Covid-19, and the second quarter reflected an even bleaker outlook for many networks as the reverberations continued.

Many major ad revenue dips have been attributed to the cancellation and postponement of live sporting events, which normally drive reliable advertising investment, as well as belt-tightening at major advertisers. The back-to-school advertising data, though, shows the reverberating and complex effects of the continuing Covid-19 pandemic throughout the calendar year as normally reliable revenue streams dry up.

Many back-to-school advertisers have opted to sit out advertising entirely this year, Kantar found in its analysis. Only six national advertisers are spending, including Target, JCPenny, Walmart, Macy’s and Amazon. Stein Mart, the discount department store, has also made some investment in TV ad spend, although much less than the others. Target and JCPenny together made up nearly two-thirds of all back-to-school advertising spend.

Last year, national back-to-school TV advertising comprised 100 retailers, according to Kantar.

Back-to-school ads, unsurprisingly, look a lot different this time around, Kantar said. Instead of featuring families shopping for school supplies and new clothes, or showing students back in the classroom with friends, most back-to-school ads this time around are focusing on online delivery of school supplies, curbside pickup or virtual learning.

The news comes as most consumers are also unsure about children returning to in-person learning. According to a consumer sentiment survey also conducted by Kantar, only 13% of consumers are comfortable sending children back to school “as soon as possible.” Instead, about 25% would prefer if kids returned to the classroom in somewhere between one and five months. But most consumers—more than half—remain unsure about the right course of action.

Of those who wanted to wait for kids to return to school, more than a third said the safety of children was their top concern, with 13% saying it would be “irresponsible” to resume in-person learning during the pandemic.

Join the foremost brand marketers, such as Marc Pritchard of P&G, Brad Hiranaga of General Mills, Kory Marchisotto of e.l.f. and more, for Brandweek Masters Live on Sept. 14-17. Secure your pass today. Early-bird rates expire 9/1.

https://www.adweek.com/tv-video/back-to-school-tv-ad-spend-plays-hooky-in-2020/