Penny stocks are some of the highest risk, highest reward assets in the stock market right now. Part of this is because you can quickly make so much money with them. A simple “buy low, sell high” strategy is all anyone needs to keep things simple.

PennyStocks.com – PennyStocks

PennyStocks.com – PennyStocks Even with the stock market crashes lower, you’ll see more than a handful of penny stocks trading higher. One of the recently popular themes that readers have followed is something known as “short squeeze stocks.”

It generally involves stocks that have big bets against them, but a violent and aggressive breakout can trigger under the right circumstances. Today we’ll look at a few hot penny stocks to watch this week with higher short interest. Will they squeeze, or will the traders with bearish bets continue winning the battle?

Short Squeeze Penny Stocks

- Splash Beverage (NYSE:SBEV)

- Singularity Future Technology Ltd (NASDAQ:SGLY)

- Petros Pharmaceuticals Inc. (NASDAQ:PTPI)

- Ocugen Inc. (NASDAQ:OCGN)

Splash Beverage (NYSE:SBEV)

Splash Beverage was one of the increasingly popular short squeeze penny stocks to watch this month. Shares surged during the second half of the month following two significant updates from the company.

Splash announced authorization receipts from Walmart (in Florida) and Ralph’s (in California) for its TapouT & Pulpoloco beverage brands. The company also signed a distribution agreement with Central Distributors of Arkansas and D. Bertonline & Sons in New York for select Splash brands.

With multiple wins this month, SBEV stock has seen no shortage of attention. Shares have climbed from roughly $1 to highs of over $5 at times. Heading into this week, SBEV stock finished its Friday session at just under $4.

Is SBEV A Short Squeeze Penny Stock?

According to data from Fintel.IO, the short float percentage for SBEV stock is lower relative to other names on this list of penny stocks. Coming in at roughly 8.58%, it isn’t your typical “high short” figure. However, in light of SBEV being a relatively lower float stock, it could be something to make a note of. Furthermore, with a low time to cover and higher borrow fee rate, traders have circulated this among lists of short interest stocks.

Singularity Future Technology Ltd (NASDAQ:SGLY)

You might not recognize this name as a familiar face regarding penny stocks. But if you’ve traded low-priced shares for a few months, you likely know the name Sino-Global Shipping. It was a popular cryptocurrency name, believe it or not, as the company transitioned. Following its name and symbol change to Singularity earlier in the month, SGLY stock has begun gaining some attention.

The new face of Sino, Singularity’s model, is focused on digital currency and the legacy shipping business. To get you up to speed, Singularity restructured a mining server purchase agreement for 2,783 servers with Hebei Yanghuai Technology Co., Ltd. Yanghuai was tasked with transporting the servers equal to half of the agreed-upon 50,440 t/s in computing power, to Sino’s Ningbo, China office. The company also appointed a new Chief Technical Officer to help develop prospects for its crypto initiative.

Chief Executive Officer, Yang “Leo” Jie, explained the new mandate in a January press release:

“We made major progress in 2021, including executive leadership changes, new strategic partnerships, and investments designed to establish our technology leadership. Both our Board of Directors and management team wanted to make the formal name change to better reflect our business, as we remain focused on accelerating growth in cryptocurrency and other new markets.”

One thing weighing on SGLY stock is the volatility in the crypto markets. This is something to keep in mind if it’s on your list of penny stocks right now.

Is SGLY A Short Squeeze Penny Stock?

According to Fintel, as of this article, the short float percentage on SGLY stock is around 6.94%. Again, it isn’t the highest short interest but something to keep in mind all the same.

Petros Pharmaceuticals Inc. (NASDAQ:PTPI)

Petros shares have flip-flopped during the final days of January. The biotech company’s stock managed to rally back slightly from an earlier sell-off thanks to launching two new studies. Petros provides therapeutics specialized in men’s health and initiated two self-selection studies for STENDRA. This is the company’s erectile dysfunction drug, and the results of the studies will be a part of a larger data package Petros expects to submit to the FDA. Its ultimate goal is achieving over-the-counter status for STENDRA.

Fady Boctor, Petros’s President and Chief Commercial Officer, explained in a January release, “The recently completed label comprehension studies and these self-selection studies continue to enable us to refine and test our draft OTC label in broad as well as in targeted patient populations. We are looking forward to reviewing these results with the FDA during a pre-IND interaction we anticipate having during the first half of 2022.”

Petros has also recently partnered with a global contract manufacturer for the commercial production of STENDRA. According to the company, this is expected to offer cost savings and gross margin increases. As commercial plans and IND speculation present potential catalysts, the market has become more active during the final days of January.

Is PTPI A Short Squeeze Penny Stock?

Based on Fintel data, the short float percentage for PTPI stock is much higher than the others on this list. As of this article, that figure sits around 13.74%.

Ocugen Inc. (NASDAQ:OCGN)

Virus fears have directed big moves in the stock market over the last few years. Some of the biggest beneficiaries have been vaccine manufacturers. Ocugen has been mixed as far as sentiment is concerned. Last year the ocular health company pivoted to vaccine development thanks to its relationship with Inda-based Bharat Biotech and its COVAXIN biotherapeutic. While last year was a big and volatile one for Ocugen, thanks to speculation on COVAXIN, 2022 has seen a much different reaction in the stock market.

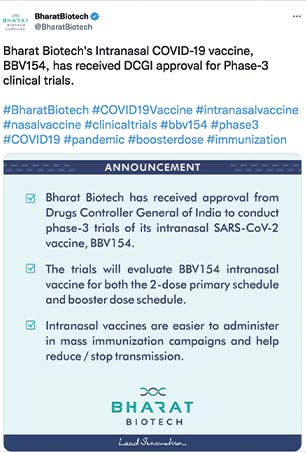

Needless to say, investors remain focused on any new or updated advancements from the COVAXIN platform, and that’s precisely what they received last week. Bharat Biotech tweeted out:

“Bharat Biotech’s Intranasal COVID-19 vaccine, BBV154, has received DCGI approval for Phase-3 clinical trials.”

The tweet came in tandem with news that Ocugen signed a letter of intent to acquire a dormant vaccine manufacturing plant in Canada. Blended together, it seems that the market has taken a bullish stance on OCGN stock heading into the new week. It will be interesting to see how this unfolds with the new month beginning.

Is OCGN A Short Squeeze Penny Stock?

If you’re looking for stocks with high short interest, OCGN could fit that mold. According to Fintel, the short float percentage as of this article sits at 27.83%.

How Do You Short A Stock?

Shorting a stock isn’t as hard as you might think. A lot depends on your broker and if a particular stock can be shorted (borrowable). The process of shorting involves borrowing shares from a broker and selling them into the public market. Then, once the trader is satisfied with the trade, they repurchase the shares, return them to the broker, and profit.

Since the expectation is that share prices will drop, the profit comes from the difference in the cost to repurchase the shares and the price at which the shares were initially sold. For example, if a trader borrows ten shares, sells them short at $100, then repurchases ten shares at $90 to return the borrow, they would pocket $10 per share.

What Is A Short Squeeze?

A short squeeze can cause significant losses for traders who short stocks. During a short squeeze, share prices don’t drop but rise instead. As more retail buying pressure comes into the market, short traders still need to return the borrowed stock.

In this circumstance, they buy back at higher prices than they originally sold short, thus taking a loss. Combined with regular retail buying, it triggers a snowball effect resulting in aggressive moves in specific stocks.

Short Squeeze Penny Stocks To Watch This Week

The thing to remember about short squeeze stocks is that volatility is a big proponent. Stocks can squeeze, breakout big, and then drop just as quickly. For this reason, it’s essential to understand how to trade volatile penny stocks and know how to set profit targets ahead of time. “Going to the moon” is excellent, but if your stock “moons” and you don’t know how to take advantage, you could miss out entirely.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!

https://www.entrepreneur.com/article/415925