Where We Were

There are a lot of words that could be used to describe 2020—“unprecedented,” for one; “pandemic” is an obvious choice. But if you’re a brand, the word that best encapsulates the year is “pivot.”

Pivoting is precisely what brands, big and small and across categories, had to do starting in March. The marketing community united around the need for rapid adjustments and overhauls. It was an impressive accomplishment, because the world of brands is a massive one, encompassing companies that make the products we desperately need in times of crisis—ahem, toilet paper—and those we most definitely do not, as much as we like them (looking at you, $1,000 handbags).

All brands seemed to realize that trends steadily creeping up on the horizon were much closer than they had anticipated. CMOs started the year with a focus on the consumer—creating more personalized experiences for them, providing them with a variety of ways to access their brands, and standing up for causes and issues they believe in. The events of 2020 didn’t change those priorities but, rather, made them paramount.

“A lot of brands talked about being incredibly customer-centric,” says Jared Fink, group director, experience at Siegel+Gale. “[In 2020], that was put to the test.”

Where We Are Now

Brands provide services we scarcely used prior to the pandemic—how many weddings were hosted on Zoom pre-2020?—as well as ones that feel like something from another lifetime. (It wasn’t a great year for selling transatlantic flights.)

The events of 2020 pushed to the forefront just how varied the positioning of those different sectors really is—and thus, what pivots they were forced to make. Companies such as Lysol and Clorox soared in 2020, thanks to an unprecedented demand for their products, forcing them to ramp up production. That, in turn, allowed them to increase ad budgets, something Clorox did three times in 2020, including a 30% bump in the final quarter of the year.

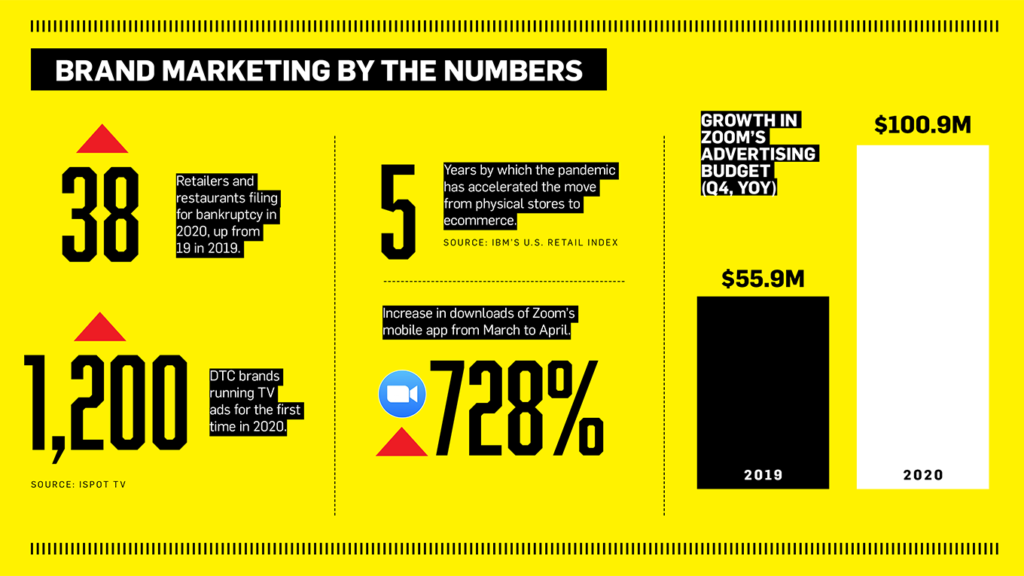

Other success stories of 2020, like Zoom, which saw downloads of its mobile app increase 728% from March to April, also put more dollars toward advertising. Zoom allocated $100.9 million in the fourth quarter of 2020, up $45 million from the previous year.

But the chaos of the pandemic resulted in more calamity than it did positivity. Travel brands are the most prominent example, with demand—and revenues—falling off a cliff. That impacted their ad spend: Very few airlines ran TV ads in 2020, save Southwest, which was often the only airline advertising on television. Retail, outside of behemoths like Amazon, Target and Walmart, was hit hard, too, with 38 retailers and restaurants filing for bankruptcy, including J.Crew, Neiman Marcus and JCPenney, compared to just 19 in 2019.

Where We’re Going

In 2021, brands will double down on the bets they made in 2020—rolling out new loyalty programs, like Walmart+; embracing new methods of getting goods in consumers’ hands, like curbside pickup or launching new direct-to-consumer channels; and trying out new advertising platforms like TikTok or, for some brands, TV (1,200 DTC brands ran TV ads for the first time in 2020, according to iSpot.tv).

And even in a future world where we’re meeting in person more, the shift to digital will persist. IBM’s U.S. Retail Index reports that the pandemic has accelerated the move from physical stores to ecommerce by five years. In 2021, that shift will continue, as brands embrace tactics like livestreaming in commerce, which has already made waves in China, and shopping on social media platforms, thanks to the 2020 debut of Instagram and Facebook Shops.

https://www.adweek.com/brand-marketing/changes-already-in-motion-for-brands-a-year-ago-will-only-accelerate-in-2021/