4 min read

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

Running a business is difficult. It’s even harder if you chose the wrong business insurance. The last thing you need is to spend untold hours searching for the insurance you need, only to find out you’ve left yourself vulnerable to lawsuits, employee injuries, or property damage after the fact.

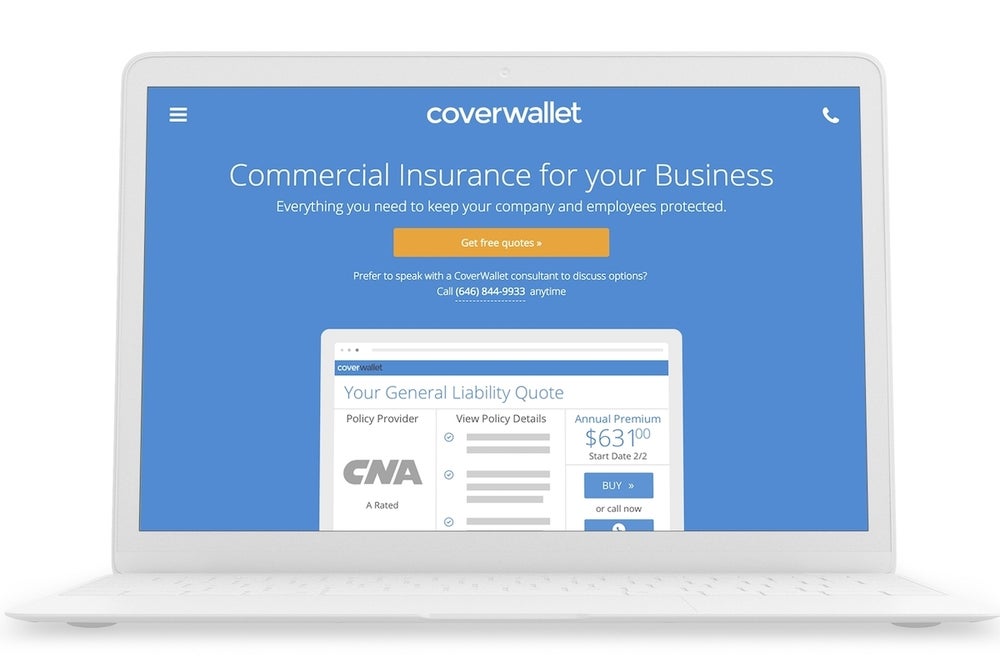

That’s why a group of tech entrepreneurs got together and created CoverWallet, an online commercial insurance marketplace and concierge service specifically designed to find the best insurance for your business in a manner of minutes.

Navigating the business insurance jungle.

Image via Unsplash

When you start a business, you assume a certain amount of legal responsibility for anybody who is affected by your business’s activities. That includes employees, clients, customers, or anyone else who steps into your shop, office, or other property. If you own a restaurant, you are responsible if a customer gets food poisoning. If you own a retail store, you are responsible if a customer slips on a wet floor. If you own a cybersecurity firm, you are responsible if one of your websites gets hacked. Business insurance protects you, your business, and your assets in the event that something goes wrong. The trick is figuring out exactly what kind of coverage your business needs.

Because there are so many types of businesses, there are literally dozens of different types of business insurance. These include things like general liability, workers compensation, professional liability, umbrella, employment practices and liability, cyber liability, business interruption, and equipment breakdown, just to name a few. And, generally speaking, most businesses will need to mix and match different types of coverage to make sure they are fully protected.

As such, figuring out exactly what you need, and then finding the best possible rates, can be stressful and time consuming. You certainly don’t want to skimp on insurance. Otherwise, one tiny mishap could wipe you out entirely. However, you also don’t want to overpay for coverage and a policy you don’t actually need.

So what’s the best way to go about getting business insurance? In the past, your best bet was to talk to other people in your industry and see if they had an insurance broker they would recommend. But today, thanks to CoverWallet, there’s a better way.

Make business insurance simple with CoverWallet.

CoverWallet was founded by a team of people with experience in software startups who were tired of how difficult it was to understand, buy, and manage commercial insurance policies. So they decided to do something about it and create a solution specifically tailored for small-to-medium sized businesses. The result is an easy-to-navigate online platform that uses state-of-the-art tech to help businesses determine what type of coverage they need at the best possible price.

When you sign up with CoverWallet, an award winning “intelligent assessment system” powered by deep analytics AI determines what types of insurance policies and features your business needs. Then, no matter what type of business you run, they get you competitive quotes from top-rated insurers. And it all takes just a few minutes to complete.

Not days. Not hours. Minutes.

Want to talk over your options with an actual human expert? You can do that, too. CoverWallet has a team of experienced advisors available 24/7 via phone, chat, or email. Then, once you’re all set up, you can manage everything online. You’ll be able to make adjustments to policies, compare coverage, and request and track certificates of insurance with the click of a button.

Maybe you’re worried your business doesn’t have the right insurance coverage. Or maybe you’re worried you are overpaying for the coverage you have. And maybe you’re so confused you don’t even know where to begin. If any of those scenarios sound familiar, take just a few minutes and get a free quote from CoverWallet. It will give you the peace of mind you need so you can focus on growing your business.

https://www.entrepreneur.com/article/356277