To bolster its investment-banking business, Cowen Inc. COWN has agreed to acquire Portico Capital Advisors, a mergers-and-acquisition (M&A) advisory firm, focused on the verticalized software, data and analytics sector. The definitive agreement was approved by Cowen’s board of directors as well as Portico Capital’s shareholders and governing bodies.

– Zacks

The deal’s consideration will comprise 75% cash and 25% stock. Other terms of the deal, expected to close in the fourth quarter of 2021, were not disclosed.

Apart from shoring up Cowen’s investment banking operations, the acquisition will garner the company’s boosted capital markets, advisory and research capabilities to its clients. Cowen expects its M&A advisory revenues to shoot up nearly 20% in fiscal 2022.

In fact, revenues of its investment-banking business have surged more than four-fold since 2017, courtesy of huge growth in its M&A and Capital Markets Advisory practices. Hence, the acquisition of Portico Capital will also create room for further revenue growth.

Via this deal, Cowen can also leverage Portico Capital’s deep-sector proficiency, sell-side focus and its track record in advising blue-chip companies and private equity firms.

New York-based Portico Capital keys in on the verticalized software, data and analytics market“a critically important, fast-growing, and dynamic sector that will underpin the global economy in the decades ahead.” said the co-president of Cowen, Larry Wieseneck.

Portico Capital’s founder and executive chairman Rick Northrop said, “For two decades, the Portico team has focused on leveraging our deep sector expertise and relationships to deliver value for our clients through focus, experience, and guidance at every step of a transaction. We are delighted to enhance our ability to deliver high-quality value to clients on the Cowen platform.”

Conclusion

Cowen’s cash and cash equivalents stood at $1.05 billion while its net liquid investment assets totaled $1.2 billion as of Sep 30, 2021. Hence, a sound liquidity profile enables the company to pursue fruitful acquisitions. Moreover, Cowen’s deal to acquire the M&A advisory firm comes during a lucrative phase in dealmaking when low-interest rates and mammoth corporate cash made acquisitions immensely enthralling.

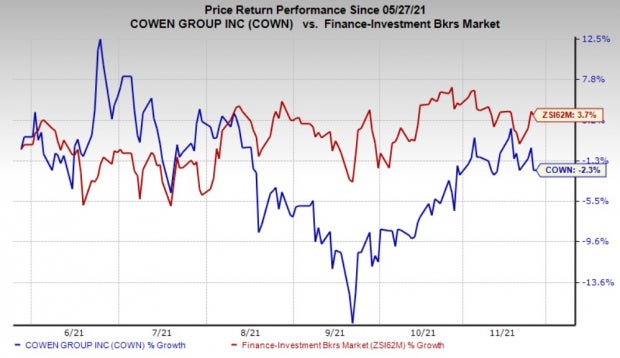

Shares of Cowen have lost 2.3% over the past six months as against 3.7% growth recorded by the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, the stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Stocks Taking Similar Steps

The financial sector witnessed a surge in deals as banks are making bolt-on acquisitions to abate costs and augment technologies.

Earlier this month, Citizens Financial Group, Inc. CFG completed its previously announced merger agreement to acquire JMP Group LLC. Citizens Financial had announced the all-cash deal in September to augment its capital-market capabilities.

The buyout is expected to foster growth, diversify Citizens Financial’s capital-market platform and provide a grander scale in the key verticals of healthcare, technology, financials and real estate.

Similarly, last month, with an aim to further diversify its deposit-gathering capabilities and revenue mix, Raymond James RJF announced a cash-cum-stock deal to acquire TriState Capital Holdings, Inc. TSC for $1.1 billion.

The transaction is still subject to approvals from the regulators and TriState Capital shareholders. Paul Reilly, chairman and CEO, Raymond James had said, “Importantly, this acquisition further illustrates our commitment to utilizing excess capital through organic and inorganic growth that we expect to drive strong returns for shareholders over the long term.”

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cowen Group, Inc. (COWN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/399725