Despite the coronavirus pandemic running its course throughout the second quarter, Facebook managed to surpass expectations for revenue and growth in its user base during the three months ending June 30.

Facebook was originally scheduled to release its financial results Wednesday, but the announcement was delayed by one day due to CEO Mark Zuckerberg’s testimony before the House Judiciary Committee’s antitrust subcommittee Wednesday afternoon.

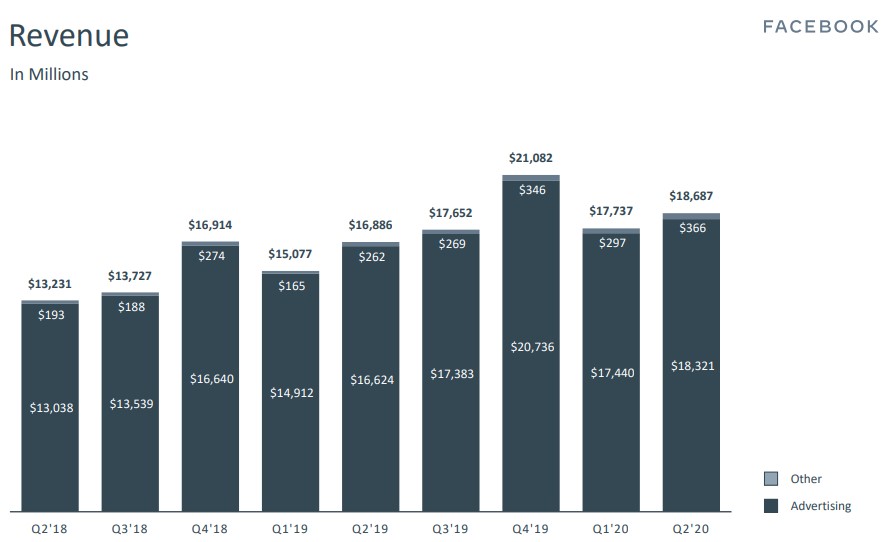

The company said Thursday that revenue for the second quarter was $18.687 billion, up 11% from $16.886 billion in the year-earlier period. As always, advertising accounted for nearly all revenue, at $18.321 billion.

Social media marketing platform Socialbakers said earlier this week that ad spend on Facebook and Instagram in North America shot up 91.7% from the end of the first quarter until mid-June, before dropping 31.6% in the final two weeks of the month and quarter, while cost per click and click-through rates for advertisers remained on a downward trend during the period.

“No other platform can offer brands and advertisers the reach and scale that Facebook can offer,” Socialbakers CEO Yuval Ben-Itzhak said in an email Thursday. “As long as Facebook and its family of applications continues to attract users, its advertising business is likely to remain strong.”

Research firm eMarketer said Facebook is the No. 2 publisher—behind Google—thus far in 2020, accounting for 23.4% of digital ad spending in the U.S., with Instagram alone representing 12% and driving nearly all ad revenue growth at its parent company.

The pandemic did negatively affect Facebook’s ad business, but less so than expected, in part, due to Instagram, according to eMarketer principal analyst Debra Aho Williamson.

“Facebook has successfully attracted digital-native businesses to its platform, especially those that market products or services that can be used or consumed by people staying at home,” she said.

Facebook does not break out Instagram’s results.

Looking ahead, Facebook projected similar results in the third quarter, already reporting that the rate of ad revenue growth was in line with second quarter, but cautioned that “continued macroeconomic uncertainty,” including the pace of recovery from the pandemic and the prospects of additional economic stimulus, would play a role.

The company also acknowledged the ongoing boycott by certain advertisers as a potential headwind.

The seeds of discontent against Facebook over its poor track record in preventing hate speech on its platform began sprouting in earnest in the late stages of the second quarter, when six civil rights groups banded together to organize an advertising boycott against the social network, but most participating brands did not take action until July 1, or the first day of the third quarter.

Tal Chalozin, co-founder and chief technology officer of video ad tech company Innovid, said in an email prior to Facebook’s earnings release that “Facebook battled with north of 1,100 advertisers pulling away their spend. However, my prediction is that there will be a marginal impact on the second-quarter number.”

Ben-Itzhak also weighed in on the earnings.

“Facebook may have taken a beating on the PR front this year, culminating with the #StopHateforProfit movement in July, but it’s encouraging to see that its second-quarter results remain strong,” he said.

Other factors that Facebook said could impact the next quarter included the impact of regulation, such as the California Consumer Privacy Act, on ad targeting and measurement, and expected changes to mobile operating platforms.

The company said shelter-in-place mandates due to Covid-19 drove increased engagement on its platform.

Monthly active users on Facebook itself averaged 2.7 billion for the quarter, up 12% compared with the second quarter of 2019, and monthly active people across the Facebook family of apps rose 14% year over year to 3.14 billion.

https://www.adweek.com/digital/facebook-outperforms-estimates-for-revenue-user-growth-in-q2/