I’ve made the argument for the importance of Google Shopping many times now, but it still doesn’t feel like reality has truly set in for many retail paid search advertisers. Put simply, Shopping is the single most important aspect of paid search management for most online retailers today, and that’s only continued to become truer in the final weeks of the year heading into 2019.

Here are my thoughts on recent trends and how things stand to shake out over the next few quarters.

Q4 indicates Google’s runway for Shopping growth is far from over

As digital ad platforms mature, it’s expected that click growth will eventually wane as user growth slows and ads become fully optimized. This is also true of ad formats within a platform.

In the case of Google Shopping, Merkle (my employer) data from Q4 2017 to Q3 2018 seemed to indicate that Google was finally starting to run out of ways to increase the amount of Product Listing Ad (PLA) traffic. Average quarterly click growth was down to 18 percent, compared to average click growth of 38 percent from Q4 2016 to Q3 2017.

Then came Q4….

Through the first ten weeks of the quarter, Google Shopping clicks grew 34 percent Y/Y, a massive acceleration from Q3, as impressions skyrocketed. This was particularly true on phones, where impression growth went from 55 percent in Q3 to 111 percent in Q4.

It’s not entirely clear where all the new impressions are coming from but looking at the corresponding text ad trends it would seem they are at least partly coming at the expense of the older ad format. Non-brand text ad clicks decreased 26 percent Y/Y over the first ten weeks of the quarter, the largest decline ever observed for Merkle advertisers, with all device types registering record declines. As such, retailers should expect to continue to put more resources towards optimizing Shopping.

For all the talk of the “death of the keyword,” the query a user types in still matters, particularly in Google Shopping. Using keyword negatives and campaign priorities intelligently can help map Shopping traffic to the best product offerings with the most appropriate bids for the queries being searched, limiting wasted spend and maximizing return. This will continue to be the case in 2019.

It will also continue to become more important to take advantage of newer format variations such as Local Inventory Ads and Showcase Shopping Ads as Google diversifies its offerings to better meet the needs of users.

Newer Google Shopping formats continue to grow in importance

We’ve come a long way since Google initially launched Product Listing Ads to appear for product-specific searches more than nine years ago, and what began as a format aimed primarily at long tail queries has evolved to provide relevant, image-based ads for many different kinds of searches.

For example, Showcase Shopping Ads are aimed at targeting more general queries with listings that feature tile ads for specific retailers as opposed to specific products, allowing Google to feature Shopping ads even when a searcher’s query isn’t specific enough to know which specific products to show.

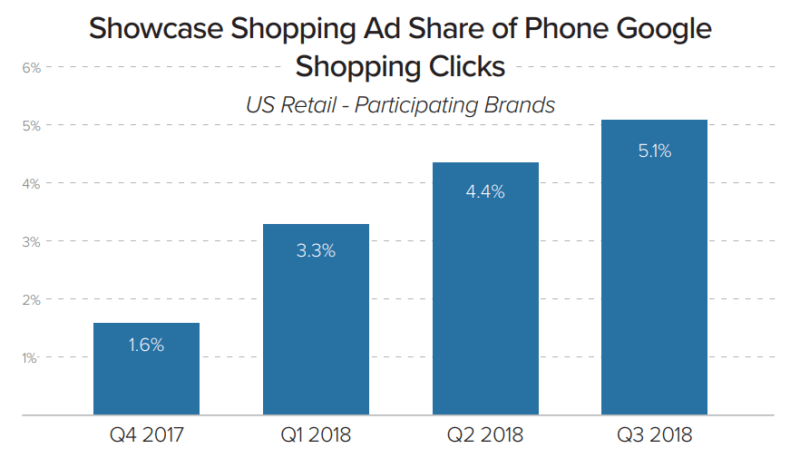

Participating Merkle advertisers have seen a steady increase in the share of Shopping traffic coming from these ads over the past year, and Google has even tested featuring a Showcase ad carousel below a traditional Google Shopping carousel on the same SERP.

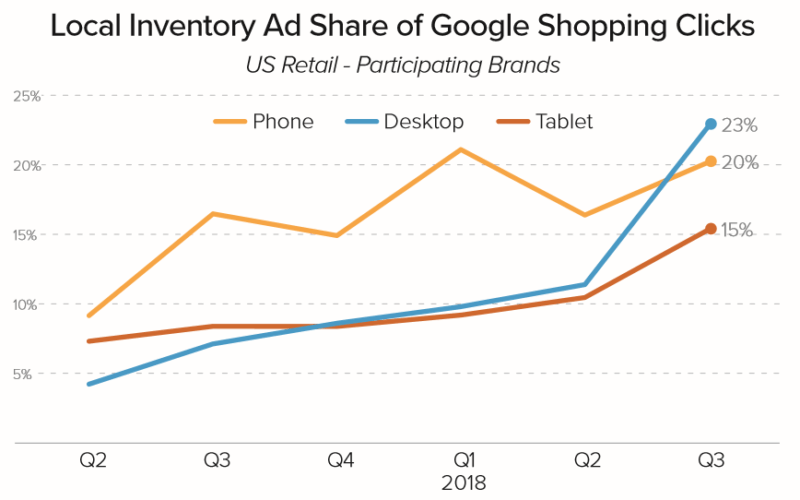

Local Inventory Ads are another Shopping variation that has grown steadily in traffic share over the past few quarters. These ads include information for when a product can be picked up at a local store and are aimed at queries that include local intent.

Historically a challenge for many retailers to participate in due to the difficulty of maintaining local feed updates, Google recently announced new partnerships with point-of-sale inventory management providers to help local businesses that are unable to produce and manage local feeds.

Brick-and-mortar advertisers know that immediate, local product availability is one advantage they have over Amazon in a world where most purchases still happen offline, and Google is making it easier for these brands to push users to store locations via Local Inventory Ads. Advertisers with physical store locations that aren’t already involved should be exploring the possibility.

Speaking of Amazon…

Google will continue its goal of uniting retailers to compete with Amazon

It’s no secret that there’s a competition raging between Google and Amazon for the hearts and ad dollars of retailers. This is playing out on multiple fronts.

One such front is Google Express, widely seen as Google’s effort to compete directly with Amazon as a product marketplace. Google makes a commission from every sale, with rates varying according to product category, and participating stores are responsible for fulfilling orders.

While Google has long pumped Google Express ads into Shopping results via ‘house ads’ which featured Google Express as the seller on ad units, it fully transitioned in October 2018 to Shopping Actions transactional units attributed to the retailer fulfilling orders.

Reactions from participating Google Express retailers have been mixed. Reporting is currently limited and supplied directly from Google reps, while billing is fairly opaque in terms of breaking down the commissions owed for different product categories.

It’s difficult to assess how well these units are driving revenue for Google relative to traditional Google Shopping ads because of the limited reporting, but early numbers indicate it’s at the very least not a clear win for Google to show Shopping Actions instead of pay-per-click (PPC) ads. Recent performance reports also indicate that Shopping Actions are showing less frequently relative to PPC Shopping ads since just before “cyber weekend,” perhaps meaning Google is less inclined to showed Shopping Actions during the busy holiday season.

That could be for fear of missing out on revenue, or it could just be a result of which users Google shows Shopping Actions to and how much of the total search population they make up during the holidays versus other periods. Google has indicated they only show Shopping Actions in situations when a searcher seems likely to purchase from Google’s marketplace, and the best indicator of such a situation is probably whether a searcher has purchased from Google Express previously. As such, shifts in the share of searchers that are proven Google Express customers might be at least partially at play in holiday Shopping Actions performance so far.

How big the Google Express customer base gets will be the primary factor determining the upper bounds of how big Google’s marketplace and Shopping Actions can be. With Google only making money out of Shopping Actions clicks that lead to conversions, it needs to be sure the searchers shown these units will be likely to convert on Google Express. If it’s customer base growth stagnates, so too will Shopping Actions. This all bleeds into what participating retailers can/should expect from the platform moving forward.

If it takes off, I’d expect Google to significantly ramp up the presence of these ad units, as well as (hopefully) build on the currently limited reporting and management capabilities available. Participating retailers want the product to succeed but need more to work with if the selling points are intended to go beyond the potential for voice orders and FOMO because of competitors participating.

That said, Google is far from reliant on Google Express in continuing to court retailers competing with Amazon. As mentioned earlier, traditional Google Shopping Ads clicks are surging, and brands still see plenty of opportunity for growth from these ads. Why else would Amazon itself be investing in Shopping?

Conclusion

I don’t often like to make predictions, partly because I hate being wrong, and partly because no one ever gets credit for being right (still waiting for the masses to notice my way-ahead-of-the-curve Grinching of voice search back in 2016). But the people want vision!

In 2019, here’s mine: Shopping will continue to be the biggest Google paid search growth opportunity for most online retailers. As such, brands need to be investing time and resources into feed management and proven campaign optimization tactics like query mapping. Advertisers also need to be taking advantage of new Shopping format variations to ensure they appear for as many relevant queries as possible.

Over the coming year, we should also gain a greater understanding of Shopping Actions’ potential. If Google Express takes off (a BIG “if”), Shopping carousels could end up mostly made up of Shopping Actions sooner rather than later. Marketers should stay tuned in to how things are developing.

More Expert Predictions

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

http://feeds.searchengineland.com/~r/searchengineland/~3/HOB54vdFM6M/google-shopping-is-largest-growth-opportunity-for-most-online-retailers-in-2019-309913