Established streamers like Netflix, Amazon Prime Video and Hulu don’t yet seem to be losing ground to streaming upstarts. Instead, new streaming services like HBO Max, Peacock, Apple TV+ and Disney+ are largely additive to older and more established services, according to new data.

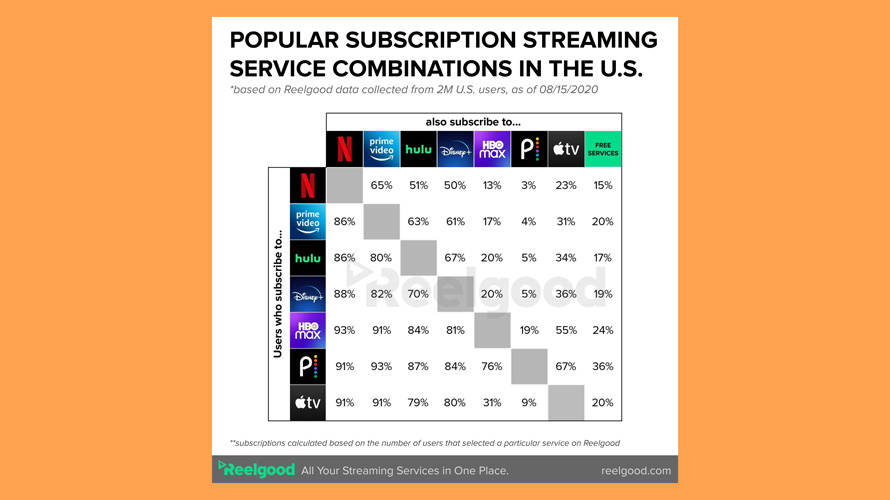

Take Netflix, which has more than 73 million subscribers in the U.S. and Canada. More than 90% of subscribers to Peacock’s paid tier Peacock Premium, Apple TV+ and HBO Max also subscribe to Netflix, and more than 85% of Hulu, Prime Video and Disney+ subscribers do, according to software company Reelgood, which allows users to access shows and movies from all of their streaming subscriptions in one interface.

Netflix customers, though, subscribe to other services less often, showing how the incumbents in the streaming landscape may be harder to unseat. Nearly two-thirds of Netflix subscribers also subscribe to Prime Video, Reelgood found, and about half also subscribe to either Hulu or Disney+. One quarter Netflix subscribers also have Apple TV+, Reelgood found, and about 13% also subscribe to HBO Max. Peacock Premium, meanwhile, had only a 3% crossover rate.

Reelgood, which had more than 2 million users in the U.S. as of this month, calculates subscription sign-ups based on which users select particular services to appear on the platform’s interface.

While the data isn’t representative of all streaming users in the U.S., and may skew toward people who subscribe to multiple services (and therefore may find more value in the platform Reelgood provides), it shows the power that established and well-funded streaming brands—with years of practice building their libraries and originals—have against newer upstarts in the ultra-competitive streaming landscape.

It also shows the complicated nature of streaming competition, which executives have said is far from a winner-take-all landscape. “Remember the subscription fatigue argument a year ago?” Marc DeBevoise, chief digital officer at ViacomCBS, and CEO and president of ViacomCBS Digital, told Adweek earlier this year. “I’m not hearing that right now, and I think that’s just because it’s not true yet. That makes a lot of us on the business side feel like there’s a great opportunity.”

There’s also an indication that viewers with subscription video-on-demand services are not necessarily flocking to free ad-supported services en masse. Only 15% of Netflix subscribers also had free services, with that rising slightly to 20% each for Prime Video and Apple TV+.

The exception is Peacock, which offers both a free ad-supported tier and paid ad-supported and ad-free tiers. (Peacock’s free tier, which NBCUniversal executives have said is intended to comprise the bulk of viewership, is calculated separately from subscription services broken out in the report.) More than 35% of users who had Peacock Premium on Reelgood also used free services, Reelgood said, the highest percentage of crossover compared to other subscription services.

Streamers, by design, have differentiation built into their libraries and programming offerings, but some streamers are more complementary to each other than others. Among Apple TV+ subscribers, 91% also subscribe to Netflix and Prime Video, while nearly 80% also subscribe to Hulu and Disney+. Those high crossover percentages are similar for services like HBO Max, but drop slightly when compared with a more family-oriented service: 82% of Disney+ subscribers also had Prime Video, and 70% also had Hulu, Reelgood reported.

It may be that viewers who are insatiable for content are the most likely to have subscriptions to newer services. At a minimum, two-thirds of Peacock Premium subscribers also subscribe to Apple TV+, and the crossover climbs when considering HBO Max, Disney+, Hulu, Prime Video or Netflix. A similar dynamic is at play for HBO Max subscribers, where, save for Peacock Premium, at minimum 55% of HBO Max subscribers were signed up to another subscription streamer.

https://www.adweek.com/tv-video/how-viewers-pair-up-streaming-subscriptions/