Medtronic PLC MDT is well poised for growth in the coming quarters owing to strong market share gain across three of its largest businesses. The company exited first-quarter fiscal 2022 with better-than-expected results. Strong recovery in the business raises optimism for the stock. However, the emergence of the new Delta variant has hampered business. Stiff completion and adverse currency fluctuations are other headwinds.

– Zacks

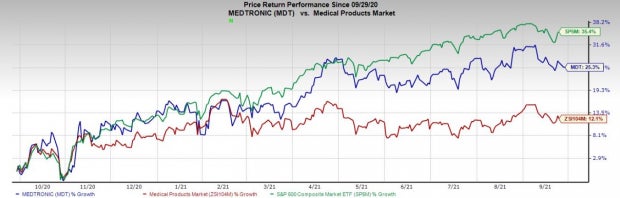

Over the past year, the Zacks Rank #3 (Hold) stock has gained 26.7% compared with 13.4% growth of the industry and 36.8% rise of the S&P 500.

The renowned medical-device company has a market capitalization of $173.27 billion. Its earnings for first-quarter fiscal 2022 surpassed the Zacks Consensus Estimate by 6.8%.

Over the past five years, the company’s earnings growth declined 1.5% versus the industry’s 6.2% rise and the S&P 500’s 2.8% increase. The company’s long-term projected growth of 8.8% compares with the industry’s growth projection of 16.5% and the S&P 500’s expectation of 11.4% growth.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors in Play

Q1 Upsides: Medtronic ended first-quarter fiscal 2022 on an extremely bullish note, with better-than-expected earnings and revenues. Barring Diabetes, each and every operating segment and geography registered strong year-over-year growth on an organic basis.

The company’s fiscal first-quarter results echoed a strong recovery of elective procedures with most of Medtronic businesses finishing at or above pre-COVID levels. This reflected solid execution and continued procedure volume recovery. The increase in the low-end of Medtronic’s fiscal-2022 EPS guidance looks encouraging as well.

Business Recovery Continues: Medtronic has exhibited strong recovery and ability to return to growth since the onset of fiscal 2022. Recovery from the pandemic and robust new product flow have led to the comeback. Further, increasing cadence of tuck-in M&As and implementation of a new operating model should add to the recovery momentum.

The company in this regard noted that the fiscal first-quarter results reflected recovery of elective procedures with most of the businesses finishing at or above pre-COVID levels. The continued improvement in monthly trends raises optimism.

Strong Market Share Gain: We are upbeat about Medtronic’s market share gains across three of its largest businesses — cardiac rhythm, surgical innovations and spine. The cardiac rhythm management business continued to perform well above the market adding over 3 percentage points of share. In surgical innovations, Medtronic gained share on strong global adoption of Endo Stapling and advanced energy technology. In spine, Medtronic’s wide product offerings, including spine implants, biologics, and enabling technologies, resulted in above-market growth.

Apart from this, the company gained share in some of its faster growing businesses like TAVR, Pelvic Health and Pain Stim.

Downsides

New COVID Variants Hamper Businesses: The emergence of the Delta variant of COVID-19 had a strong impact on Medtronic’s procedure volumes in certain geographies in the fiscal first quarter. In Pain Stim, the company noted a gradual slowdown in permanent implants and trialing procedures in the latter of the first quarter. In cardiovascular, Medtronic continued to lose share in the cardiac diagnostics business. The company also lost share in the neurovascular business.

Competitive Landscape: Medtronic earns majority of revenues from CRDM, Spinal and Cardio Vascular segments, where it faces stiff competition from MedTech bigwigs. In the CRDM segment, the company competes with notable players like Boston Scientific Corp. BSX, among others.

Exposure to Currency Movement: Medtronic is highly susceptible to currency fluctuations since the company records a significant portion of its sales from the international market. Unfavorable currency movements have been a major dampener over the last few quarters, as is the case for other key MedTech players.

Estimate Trend

Over the past 90 days, the Zacks Consensus Estimate for Medtronic’s earnings for 2022 has moved 0.4% north to $5.7.

The Zacks Consensus Estimate for second-quarter fiscal 2022 revenues is pegged at $7.9 billion, suggesting a 4.3% rise from the year-ago reported number.

Key Picks

Two better-ranked stocks from the Medical-Products industry include Envista Holdings Corp. NVST and BellRing Brands, Inc. BRBR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Envista Holdings has a long-term earnings growth rate of 27.4%.

BellRing Brands has a long-term earnings growth rate of 29.1%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

Medtronic PLC (MDT): Free Stock Analysis Report

Envista Holdings Corporation (NVST): Free Stock Analysis Report

BellRing Brands, Inc. (BRBR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/388256