Meet you in Vegas?ADWEEK House will be steps from the Aria during the industry’s big tech moment on January 8. RSVP.

The data unit Epsilon has emerged as one of Publicis Groupe’s biggest weapons of its recent success, helping its stock soar nearly 70% since the beginning of 2023.

“Epsilon and Publicis Media operation are now totally intertwined and at the heart of our connected media ecosystem,” CEO Arthur Sadoun told investors in its Q3 earnings call this year.

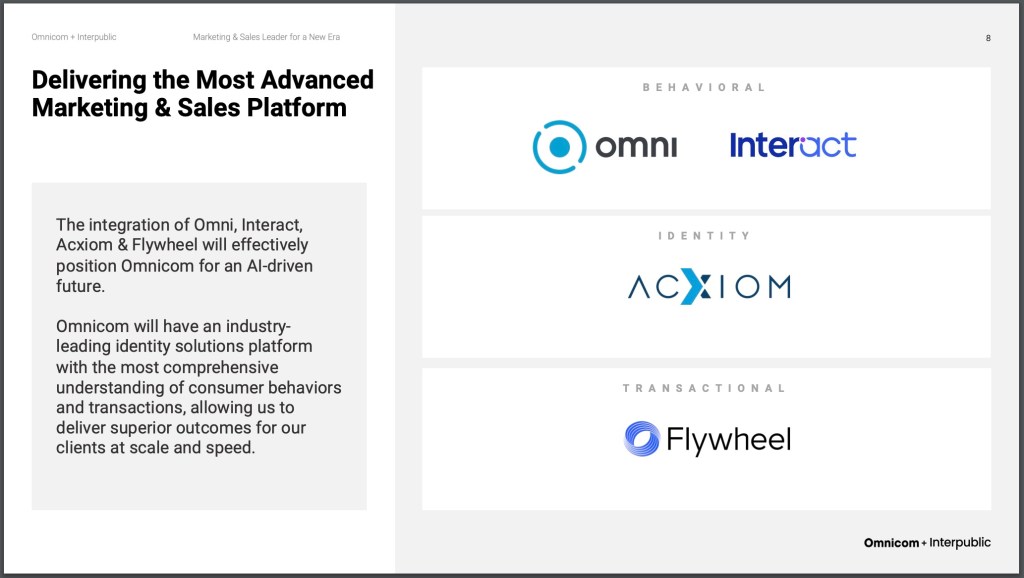

Competitors Omnicom and IPG, in the early stages of a $13 billion mega-merger, claim to have the assets to rival Publicis’ data prowess. The investor presentation of the acquisition touted the integration of Omnicom’s Omni (which provides insights from data), Omnicom’s Flywheel (commerce data provider), IPG’s Interact (a marketing platform), and IPG’s data unit Acxiom.

Yet, neither Omnicom nor IPG had individually been able to match Publicis’ data capabilities, according to multiple sources familiar with their data strategies. The stakes were especially high for IPG, which has spent billions to acquire a data unit.

Many are skeptical that a newly merged company can seize the advantage by combining capabilities.

“It’s four years too late,” said one source familiar with the matter, speaking on condition of anonymity. “This should have all been done before the onset of AI. Publicis is probably much better positioned because they did the hard work first.”

An Omnicom spokesperson said that the company believes that with IPG, “we will have the most advanced marketing and sales platform in the industry.”

ADWEEK spoke with seven sources who have worked at Omnicom, IPG, or Publicis. Some have worked across multiple of these holdco data units. They explained what Publicis did right, how IPG fell behind, and revealed what the merged holdco would need to do to catch up.