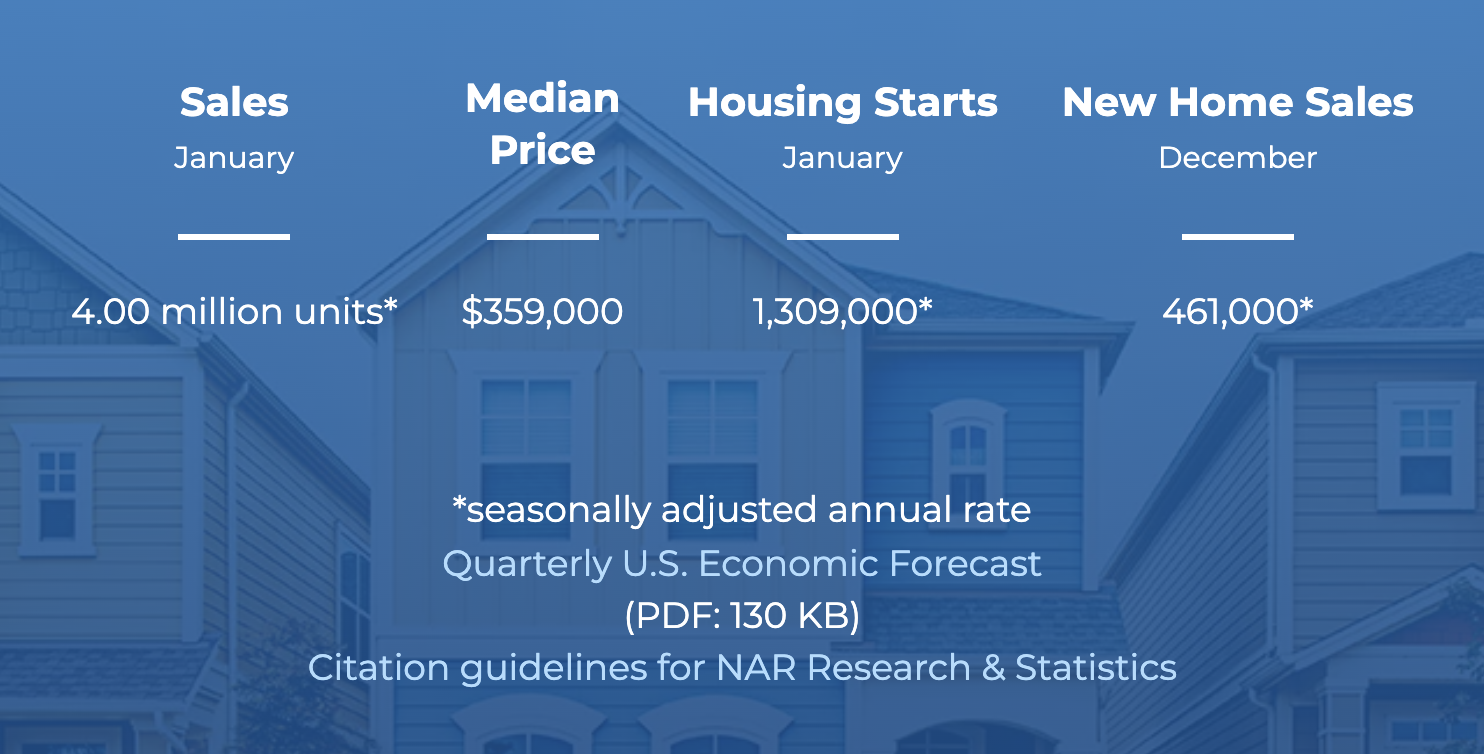

The real estate market is in an interesting state right now. Home sales are slowing because of higher interest rates, but prices in some areas have yet to drop. Overall, the median existing home sales price in January 2023 was up 1.3% from the same time last year, but home prices in expensive areas have gone down, while prices in less expensive areas have gone up.

Considering that home prices were reaching record highs in 2021, one would expect them to have normalized with the slowing market, but that has yet to happen. However, if interest rates continue to rise, prices should continue to drop.

But what does that mean to you and your finances? This article will explore how the current real estate market can impact you financially.

Real Estate Situations that Can Affect Your Finances

There are several situations that you may find yourself in where the real estate market may affect your finances.

1. Buying a Home

If you’re in the market to buy a home, you’re going to pay a higher interest rate than you would have in 2021. However, the inventory of homes is high and the number of buyers is down. That means that you may have more negotiating power with sellers. Prices may be higher, but chances are, most sellers are very motivated which could put you in the driver’s seat.

But you’ll end up paying a higher rate, but with a lower price point for the home, so it may even out for you financially. You can also refinance later if interest rates go down and get ahead of the game.

Be sure to do your research into what is happening in your area in terms of prices and the number of sales that are occurring. Every local market is different. Make sure that your real estate agent talks to you about current comparable sales, and use your negotiating power.

2. Selling a Home

If you’re planning to sell your home in the near future, you may be under a bit of pressure. Buyers are fewer in many areas due to the higher interest rates, so the people that are buying have the negotiating power. If you can, you may be better off waiting to sell until rates go back down. However, what will happen with interest rates and when is a great unknown.

If you need to sell and you want to get a specific profit on what you paid for the home or on what you owe on your mortgage, you can calculate here what price you need to stick to.

Often the best strategy in this kind of market is to price your home higher than what you actually need. That way the buyer can negotiate and feel like they’re getting a deal. It cannot be stressed enough, however, that the best strategy depends on your local market.

Do your homework and talk to your real estate agent about what is happening in your market and what comparable homes are selling for. And if you need to make a certain profit on your home, you can stick to your guns and wait for that buyer that “must have” your home.

Work with your agent to make your home as appealing to buyers as possible by making repairs or upgrades and staging the home well. In a tough market, you need to make your home stand out from the competition.

Also, work with your tax advisor when considering the price that you need to get. Selling at lower price means less in capital gains tax, so that will have an impact on your finances overall.

Special note: there was $400mm in sales in January 2023.

3. Investing in Real Estate

Investing in real estate right now is an interesting proposition. Warren Buffet said “be greedy when others are fearful”. Real estate investors right now are fearful of economic and market instability; however, having that kind of outlook depends on your goals and your risk tolerance.

If you’re looking to flip houses as an investment, it’s likely that you can find deals, particularly on distressed properties. But with the number of home buyers decreasing, you may find yourself having trouble finding a buyer and thus incur carrying costs. You can still make a profit, though, if you can put minimal money into the property and price it competitively based on local real estate conditions.

Your best bet if you want to flip homes now, is to carefully analyze each potential deal, including what is happening in the specific area the property is in, and cherry pick only the deals that make the most sense and have the least risk. With so many “fearful” investors, you’ll have less competition, so you can afford to be choosy.

If you’re considering buying rental properties, it’s still a matter of looking at each deal. The higher interest rates mean that fewer buyers are buying and are renting instead, which can drive rents up. That’s great if you can find a great deal and pay cash for the property. If you need to finance the property, however, you’ll be paying a higher interest rate which will reduce your cash flow.

The bottom line is, if you’re considering investing, you have to really understand your local market. Do considerable research before making a decision.

5. Refinancing Your Mortgage

Clearly, if your current interest rate is lower than current mortgage rates, refinancing your mortgage may not be a good idea, and vice versa. You also have to consider your closing costs when deciding if refinancing is financially beneficial.

If you are refinancing to a lower rate and getting cash out from your equity, you may find that when the bank assesses your home’s market value, it may be lower than you think. Again, it depends on what’s happening to prices in your local market.

If you want to refinance to a shorter loan term, you may still be able to benefit. Rates on 10 or 15 year mortgages are generally lower than 30 year mortgages, but your payment may still be higher because of the shorter term.

Another thing to consider is that lenders tend to be more conservative in a slow real estate market, so it may be more difficult to qualify for the refinance. Credit score and income requirements will be tighter, so be prepared to go through a more rigorous application process.

Your best bet is to shop around for the best rates and terms, analyze your options, and decide which option, if any, is right for you.

Here is a nifty refinance mortgage calculator to help you.

6. Home Equity Loans

If you’re considering getting a home equity loan, whether the real estate market will impact you depends on your goals.

If you want a home equity loan to consolidate other debt, current mortgage rates are still likely lower than the rates on other debt such as credit cards. However, similar to a cash-out refinance, your equity may not be as high as you expect based on market values.

If you want a home equity loan to remodel your home, if you’re doing it just because you want your house to be nice and you can afford the payments, go for it. You might want to consider a home equity line of credit with a variable rate so that the rate goes down when rates go down in general. However, rates may also go up.

If you want a home equity loan for remodeling, but with the goal of selling your home for a higher price in the near future, you’ll need to give it careful consideration. If rates continue to rise and home prices fall, you may not get your money back from the remodeling you do and the interest you pay on the loan. Be sure not to overdo your improvements.

7. Renting

Fewer people buying homes means more people renting, which is creating a rental shortage due to high demand. As a result, in 2023 many predict that rental price growth is likely to remain high, which is bad news for renters.

Other economic factors are also decreasing the amount of income that renters can spend on rent. What this means is that rentals in higher-priced areas will be less in demand, which should start to force prices on those rentals down a bit.

In the longer term, rental prices are likely to start to come back down, so if you’re finding it difficult to afford current rents, you may only be struggling temporarily.

As with all the other effects of the real estate market, how the current conditions will affect renters is location dependent. If you’re in the market for a new rental, do your homework and shop around, and don’t be afraid to negotiate with landlords to try to get a better rate.

In Closing

The real estate market is interesting right now, and it’s difficult even for experts to predict exactly what will happen in 2023 and beyond. Many factors will have an impact on the market’s direction, so you should stay informed about what’s happening in the market, particularly in your area.

If you’re in any of the situations discussed, be sure to do your market research and look to professionals, whether it be a real estate agent or a financial advisor, for advice. By doing so, you can find ways to successfully navigate this unpredictable market and protect your finances.

The post How the Current Real Estate Market Can Affect Your Finances appeared first on Due.

https://www.entrepreneur.com/finance/how-the-current-real-estate-market-can-affect-your-finances/447437