Back in March, when it was recognized that the COVID-19 pandemic was taking hold in the US, the IRS extended the filing deadline and the deadline for federal tax payments so that those of us who suddenly had to figure out how to work at home or handle homeschooling would get a break from dealing with taxes.

The vacation is over. The new deadline for filing your 2019 taxes is July 15th, and it is fast approaching. Whether you’re a full-time worker dealing with a single 1040 or a freelancer / gig worker getting a series of 1099s, the fastest way to pay the piper these days is to do it online.

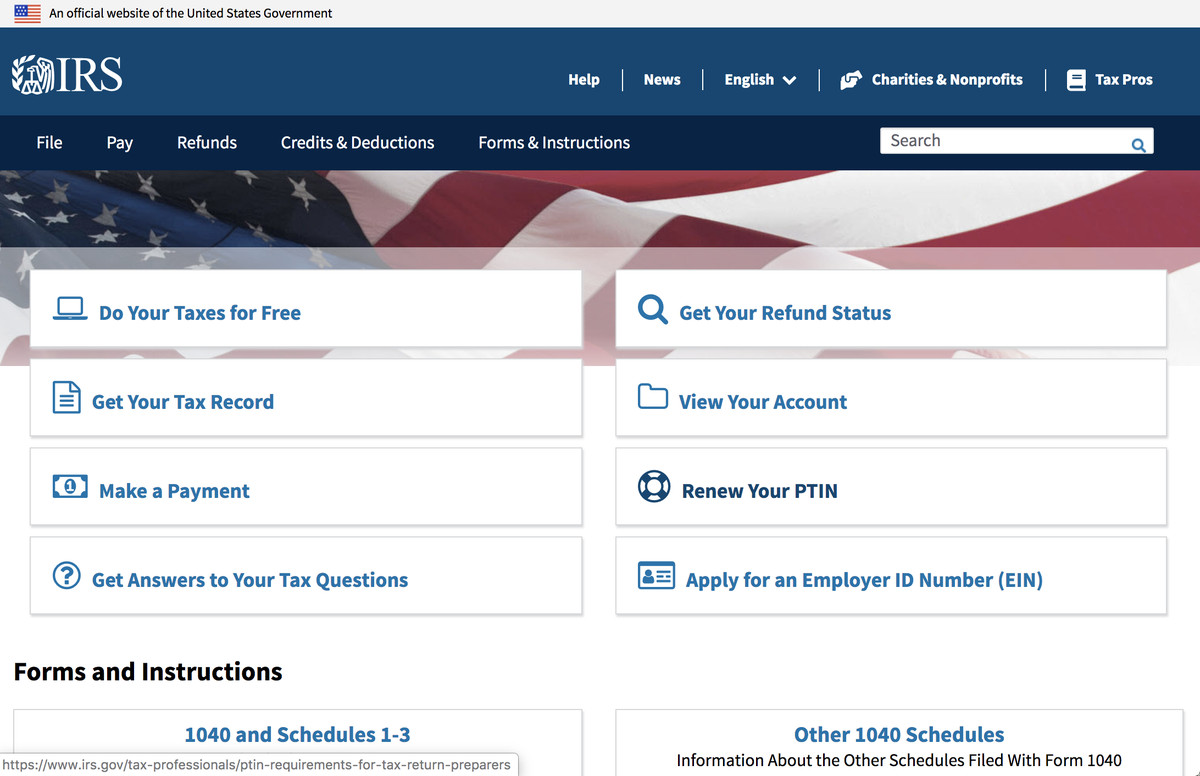

The IRS offers a series of directions on its website to help US citizens figure out their taxes, report those taxes, and send in payments (or ask for refunds) using its e-file online method.

Here’s a rundown of what’s available and where you can find it.

How do I file online?

There are several ways to file online, depending on your income and your comfort level in dealing with the whole income tax process.

If your adjusted gross income (that’s line 7 of last year’s Form 1040) is $69,000 or under, you can use the IRS Free File Online option. The site offers a number of third-party services that can help you put together and file your taxes free of charge. Of course, that is assuming the third party doesn’t try to scam you into paying more than you have to; in April of 2019, ProPublica revealed that TurboTax and other suppliers were deliberately hiding the pages for their free services in order to convince taxpayers to purchase additional features. As a result, the IRS published new rules prohibiting these practices. Still, it pays to be careful.

If your income is above $69,000, you can still use fillable forms provided by IRS Free File, but you don’t get the support of the free software and you can’t do your state taxes through this method. So unless you’re a pro at filling out taxes, you’re going to either have to use e-File with one of the available software solutions or find a tax preparer who can do it for you. In the case of the latter, the person or company who does your taxes needs to be authorized to e-file; you can check to make sure at the IRS site.

How do I pay online?

The IRS lists a variety of ways you can pay your taxes online.

If you use e-File, you can have the IRS pull the funds directly from your bank account via Electronic Funds Withdrawal at the same time you file. You can also use IRS Direct Pay to pull funds from a savings or checking account.

Finally, you can use a credit or debit card to pay online, on the phone, or via your mobile device. In this case, there is usually a fee involved (since the IRS isn’t going to absorb what your credit card company is charging for the service).

How do I get my refund?

One of the ways the IRS tries to convince you to file online is to assure you that you will get your refund faster — in less than 21 days, in most cases. Once you’ve e-filed, you can check the status of your refund online; you can also download the official IRS2GoApp, which allows you to check the status of your refund, pay your taxes, and get other information.

What about my Economic Impact Payment?

Back in March, it was announced that tax filers, along with certain classes of people whose income didn’t demand that they file income taxes, would get an Economic Impact Payment. This payment was meant to offset some of the economic hardship suffered by people who suddenly found themselves without an income as businesses throughout the US closed to deal with the pandemic. The maximum amount provided was $1,200; individuals making over $75,000 and married couples making over $150,000 would have that amount reduced.

Presumably, you should have gotten yours already; if not, you can find out why on the IRS site. Incidentally, the EIP will not be considered taxable income when you file your 2020 taxes next year.

Update July 2nd, 2:30PM ET: This article was originally published on January 31st, 2020, and has been updated to include the new IRS file-by date and info about the EIP.

https://www.theverge.com/21311416/taxes-online-file-how-to-irs-deadline-date