If they offer you credits with very few or no requirements (the most common being “No Bureau” or “We don’t check Bureau”), run!

4 min read

Opinions expressed by Entrepreneur contributors are their own.

For more than nine years I have directed Prestadero , an online credit fintech. In this period I have heard countless stories from people who are victims of fraudulent credit companies ; that is, companies that promise a loan with few requirements, but that in the end ask for an advance to be able to release the amount that is never deposited to the applicant.

The modus operandi of these financial ducklings is practically the same:

- They offer credits with very few or no requirements (the most common being “No Bureau” or “We don’t check Bureau”).

- They receive your application and tell you that the credit is authorized.

- They ask you to deposit an advance to be able to deliver the loan (arguing analysis costs, administrative costs, contract shipping costs, among others).

- Once you deposit the advance, you never see your credit and they stop answering you or disappear.

I know that some readers will say that it is very easy to avoid this type of fraud and that they would never be disappointed. But the combination of need, lack of financial education, and the sophistication of the cheaters continues to generate disappointed people. There are companies that have Internet portals, that claim to have their process validated before a notary, that even send you a photo of the check in your name to convince you that the credit is already authorized before disappearing with your advance.

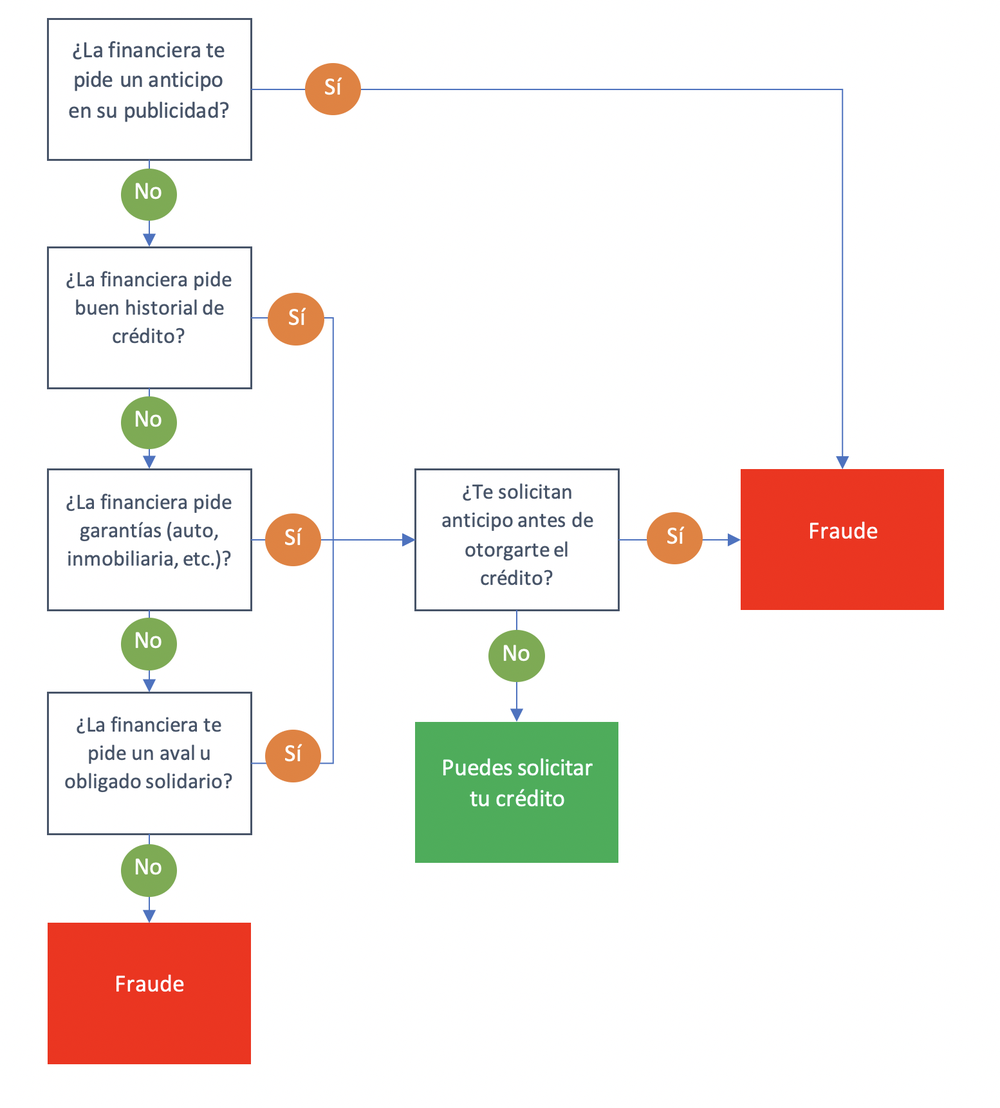

So, once and for all, I have decided to unmask these companies with a simple process to detect whether or not the credit is fraud. You just need to follow this flow chart to find out if it is a legitimate company or a fraud:

Image: Courtesy Prestadero

Some skeptics will ask why there is no legitimate situation in which the financier asks you for an advance for a loan. But why would you ask for an advance if you can perfectly charge an opening commission and subtract it from the deposited credit? It just doesn’t make sense, unless there is a possibility or certainty that you will not grant the requested credit.

There are many ways to identify if it is a fraud, but always, when it is a fraud, they ask you for an advance. Other common ways to identify fraudulent companies are:

- They ask you for credit with minimal or no requirements.

- Despite point 1., the credit they offer you is at enviable rates.

- They are not incorporated companies (although for this you have to go to the Public Property Registry ).

- When looking for reviews on the Internet, you realize that there is no trace of the company or the reviews are terrible where someone has already complained about fraud.

- They use WhatsApp or Facebook to contact you, and they ask you to send information to a non-institutional email (such as Gmail, Hotmail, Yahoo, etc.).

- Their Internet portals (if they have any) are extremely basic and without functionality.

- They use names of legitimate companies to say that they are going to get credit from said company, but in reality they do not have institutional mail, and again, they ask you for an advance when the legitimate company does not.

As you will see, there are many strategies and techniques to cheat, but if you are in this situation, follow the flow chart that I developed and you will never fall for this sophisticated deception. Enough that these deceptions continue to proliferate and abuse the needs of the people.

https://www.entrepreneur.com/article/358526