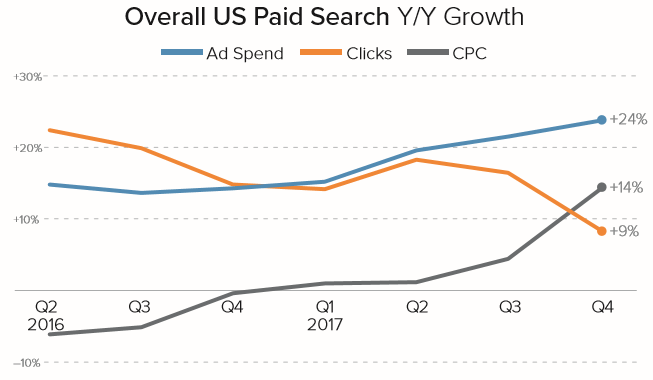

Overall, in Q4 2017, search ad click volume growth slowed by 9 percent as the average cost per click (CPC) increased 14 percent. Spend rose 24 percent year over year. Engagement and conversion performance from search ads improved, however, and clicks from phones accounted for 50 percent of all clicks for the first time. Those are among the findings reported in Merkle’s Q4 2017 Digital Marketing Report.

These search ad trends are consistent with the Q4 performance trends reported by Marin Software last week.

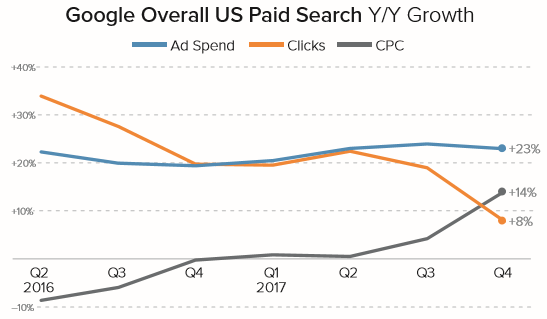

Google ad spend growth slowed slightly from Q3

Spending on Google search ads increased 23 percent overall year over year in Q4 2017. Retail and consumer goods spending on search ads rose 24 percent during the holiday season, according to Merkle’s Q4 2017 Digital Marketing Report.

That growth in search ad spend is actually a slight deceleration from Q3. Search spend jumped 38 percent on mobile and 21 percent on desktop. Click volume growth slowed sharply to 8 percent.

Brand queries drove Google CPCs higher in Q4, with a year-over-year increase of 23 percent — after falling 13 percent after Google implemented a change to Ad Rank thresholds. Additionally, non-brand text ad bid minimums for the first page of results rose by as much as 23 percent year over year in Q4. Merkle says that minimum bids for non-brand ads were flat throughout Q4 2016.

Audience targeting — Customer Match, Similar Audiences and RLSA — accounted for 30 percent of Google search ad clicks in Q4, up 10 percent from the previous year.

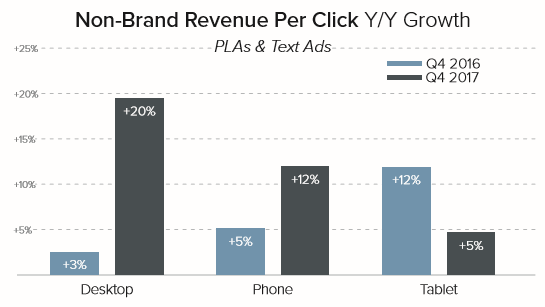

Non-brand text ad spend growth slowed from 20 percent in Q3 to 12 percent in Q4; however, conversion rates and sales per click improved. In a related area, Merkle cites a decline in non-brand traffic from Google search partners, which tend to drive lower cost but lower quality traffic.

The traffic quality improvements from Google search ads are reflected in the value of non-brand clicks. Desktop revenue per click (RPC) rose nearly 20 percent from the previous year in Q4. Phone RPC increased 12 percent year over year. The exception was non-brand tablet traffic, which represents a smaller share of overall clicks.

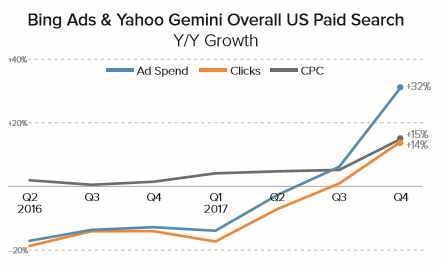

Bing Ads & Yahoo Gemini see Q4 spend surge

Across the Bing and Yahoo search networks, search spend bounced up 32 percent year over year, while click volume growth increased from just 1 percent in Q3 to 14 percent in Q4. CPCs were up 15 percent year over year in Q4 compared to just 5 percent in Q3. Merkle says the increases were largely due to advertisers focusing more on non-brand ads, which have higher CPCs than brand.

Shopping ad growth trends keep going up for Google & Bing

Spending on Google Shopping continues to grow faster than spending on text ads among retailers. Google Shopping spend increased 32 percent compared to a steady 15 percent for text ads year over year in Q4. Among Merkle retail clients, Google Shopping accounted for 55 percent of Google search ads clicks in the US and 58 percent in the UK.

Local Inventory Ad share also continued to rise on mobile, generating 11 percent of mobile Shopping ad clicks in Q4, up from 7 percent the prior year.

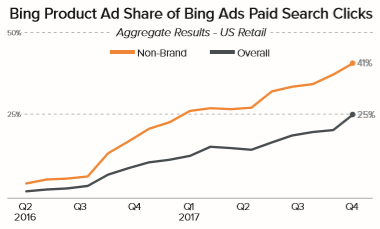

Bing Product Ads also saw spend increases in Q4, driven (surprisingly) by mobile traffic, which increased sevenfold year over year and nearly doubled from Q3. Bing Product ads spend rose 62 percent, while CPCs fell 11 percent, largely as a result of the increase in mobile clicks. Product ads accounted for 25 percent of Bing search ad clicks overall and 41 percent of non-brand ad clicks among retailer clients in Q4.

The full report can be downloaded here (registration required).

http://feeds.searchengineland.com/~r/searchengineland/~3/dXdXjI19sxY/merkle-q4-2017-search-ad-click-growth-fell-ad-spend-rose-23-across-google-bing-yahoo-290653