It turns out Stranger Things isn’t just a popular show, but a key player in Netflix’s growth.

Netflix bounced back from a disastrous second quarter, adding 6.8 million subscribers and bringing in $5.2 billion in revenue over the past three months, up from 6 million subscribers and $4 billion the same time last year. The company now has more than 158 million subscribers worldwide. The numbers suggest that Netflix is seeing a rebound in subscriber growth, even if it’s not as much as Netflix may have hoped.

Following today’s earnings, Netflix’s stock jumped back up, showing a sign of confidence from Wall Street. Netflix’s stock had dropped around 23 percent since its second quarter earnings in July, which marked the first time the company had lower subscriber growth since launching its streaming service in 2011.

This increase in subscriber growth this quarter came from an affluence of original content, including Stranger Things’ third season, which saw 64 million accounts watch the newest season in the first four weeks, according to the company. Netflix recently signed co-creators Matt and Ross Duffer to an overall deal with the streaming service, which will see them produce more TV shows and films for Netflix.

This is the final calm before the storm for Netflix. The next time Netflix reports earnings, there will be two major new entrants in the streaming market: Disney and Apple. Some analysts are concerned that Netflix could see a dip in streaming subscribers, its core business, as people test out new services, Disney+ and Apple TV Plus. Other analysts are less concerned, citing Netflix as the dominant player in streaming right now.

“In this environment the stock looks vulnerable and I question its upside potential when Netflix will soon face significant, real competition from a variety of media companies all launching their own streaming services at a substantial discount to the fees Netflix is charging,” Haris Anwar, senior analyst at Investing.com, told The Verge ahead of Netflix’s earnings.

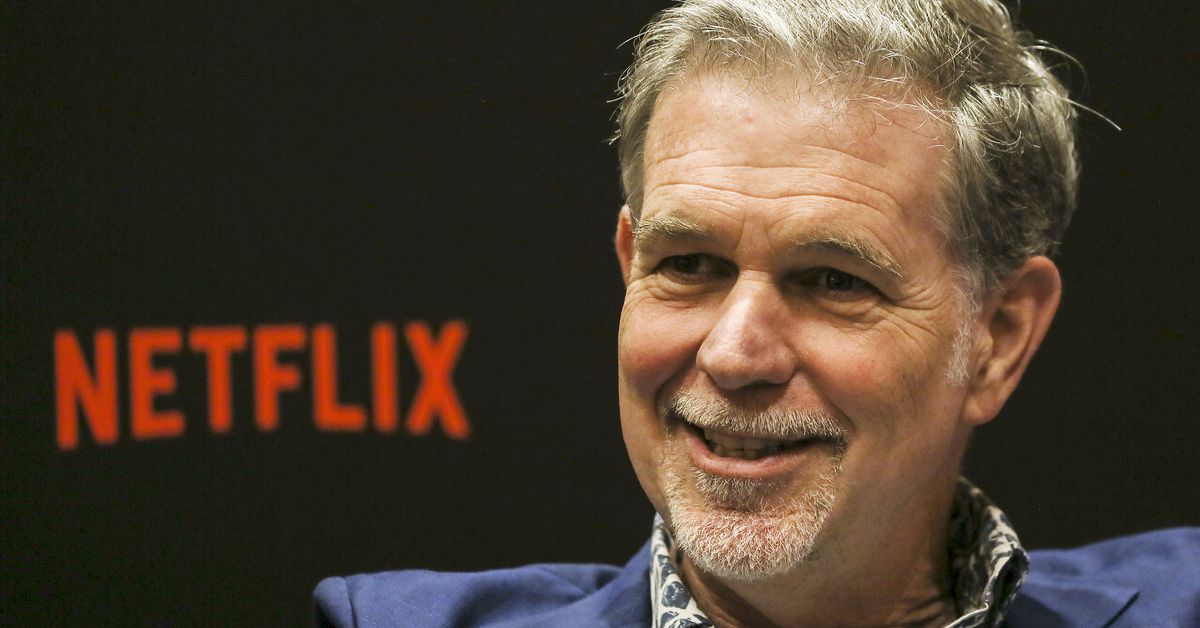

Still, Netflix executives are aware of the wave of new competition they’re facing. CEO Reed Hastings recently admitted that it’ll be “tough competition” once all the different services are available for customers. That includes entrants from AT&T’s WarnerMedia (HBO Max) and Comcast’s NBCUniversal (Peacock) in 2020, too. (Disclosure: Comcast is an investor in Vox Media, The Verge’s parent company.)

“While the new competitors have some great titles (especially catalog titles), none have the variety, diversity and quality of new original programming that we are producing around the world,” Hastings wrote.

This clash is colloquially being referred to as the “streaming wars,” and recent months have proven the real battle is over exclusivity deals. First-look deals with Hollywood’s top showrunners, including J.J. Abrams and Game of Thrones creators David Benioff and D.B. Weiss, are routinely hitting nine figures. Bidding wars over long-running, adored series like Seinfeld and The Big Bang Theory are reaching north of $500 million. Netflix has to spend more in order to continue scaling and offering exclusive series.

“The likely outcome from the launch of these new services will be to accelerate the shift from linear TV to on demand,” Hastings wrote.

To ensure it can bid against Disney, Apple, WarnerMedia, and NBCUniversal, Netflix has increased its debt load in order to spend more on content. Netflix executives have long said that getting away from licensed content and spending more on in-house development should theoretically lessen that load. Netflix is still bidding on precious licensed series, spending $500 million to obtain the global streaming rights to Seinfeld and stealing it away from Disney-owned Hulu, but it hasn’t been as aggressive about claiming older series. Instead, WarnerMedia and NBCUniversal have fought tooth and nail to get important series like The West Wing, Friends, and The Office on their own upcoming streaming services.

It’s a busy time to be a consumer of entertainment, and a turbulent period for those delivering new shows and movies directly to customers. Netflix has to expand its reach, looking at markets like India and South America as growth sectors. Hastings has suggested that India could produce more than 100 million new subscribers alone. But some analysts have found that India isn’t growing as fast as Netflix would like, despite the company pouring resources into developing more original content.

Despite the trepidation some people have about Netflix, especially as the streaming wars are really just beginning, the company isn’t in any real threat. It’s producing more originals than any of its competition, has a substantial lead in subscribers compared to its competitors, and is still a household centerpiece. While concerns about quality of programming have circulated, on top of frustrations from fans and creators over Netflix axing shows before their third season, Netflix executives seem to have a strategy in place.

“Amazing content can be expensive,” Hastings wrote in his letter to shareholders. “We don’t shy away from taking bold swings if we think the business impact will also be amazing. We don’t close every deal we chase and we don’t chase every deal on the table. And while not all projects that we do pursue will work out, our large and growing subscription base helps enable us to try many approaches.”

https://www.theverge.com/2019/10/16/20917387/netflix-streaming-wars-earnings-subscribers-q3-disney-apple-stranger-things