Tweets about television are up in nearly every category from March 1 through April 15 compared with the same time last year, largely driven by the coronavirus pandemic, Nielsen found in a study, but one category stands out as a glaring exception: sports.

Nielsen Social Content Ratings found that social interactions about children and family movies were up a whopping 588% over that time period, followed by: Hispanic talk and news (71%); streaming services (52%); primetime talk and news (17%); and entertainment series and movies (2%).

Social interactions about Hispanic entertainment actually saw a 23% drop.

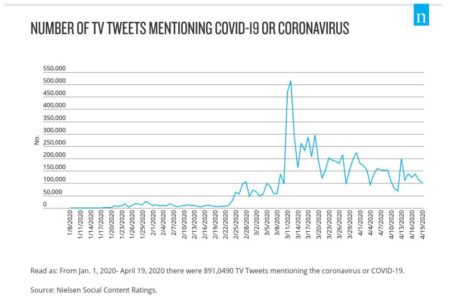

Nielsen Social Content Ratings also found that the number of TV-related tweets that mentioned Covid-19 or the coronavirus skyrocketed by 40 times in March compared with January.

However, live sports has been nonexistent for roughly six weeks, so what are Twitter users who are normally heavy sports viewers tweeting about, and what does this mean for brands trying to reach them?

Nielsen said, “Now more than ever, it is important for brands to find the right audiences, set the right tone and prepare for the future. Sports-heavy networks and advertisers have an opportunity to find aligned audiences in other TV programming and ride the momentum of recent increases in TV consumption. The overlap in social TV audiences is a way to identify and keep track of what these social sports fans are watching and talking about at scale.”

The company shared the top five TV shows that fans of sports that are currently on hold have been tweeting about during the coronavirus pandemic, by affinity share, breaking the results out by league: Major League Baseball, Major League Soccer, Nascar, the National Basketball Association and the National Hockey League.

Linear TV:

MLB:

- Man v. Food, Food Network, 45.24%

- Cavuto: Coast to Coast, Fox Business Network, 30.92%

- Making Money With Charles Payne, Fox Business Network, 28.9%

- Varney & Company, Fox Business Network, 28.47%

- DC’s Legends of Tomorrow, The CW, 28.46%

MLS:

- The Wall, NBC, 9.25%

- Me Caigo de Risa, UniMás, 6.39%

- DC’s Legends of Tomorrow, The CW, 6.24%

- Hoy, Univision, 6.07%

- Who Wants to Be a Millionaire, ABC, 5.79%

Nascar:

- Live PD: Wanted, A&E, 13.29%

- America Works Together, Fox Business Network, 12.74%

- Last Man Standing, Fox, 11.32%

- Deadliest Catch, Discovery, 11.13%

- Live PD: Roll Call, A&E, 11.03%

NBA:

- Man v. Food, Food Network, 84.78%

- The Wall, NBC, 80.11%

- DC’s Legends of Tomorrow, The CW, 70.32%

- Desus & Mero, Showtime, 70.12%

- Nick Cannon Presents: Wild ‘n Out, VH1, 65.37%

NHL:

- Man v. Food, Food Network, 57.04%

- Bar Rescue, Spike, 41.39%

- The Next Revolution With Steve Hilton, Fox News Channel, 40.4%

- The Greg Gutfeld Show, Fox News Channel, 39.11%

- Varney & Company, Fox Business Network, 38.3%

Streaming:

MLB:

- Last Chance U, Netflix, 27.14%

- Tom Clancy’s Jack Ryan, Netflix, 21.36%

- Medal of Honor, Amazon Prime Video, 21.34%

- Narcos: Mexico, Netflix, 20.43%

- Sunderland ‘Til I Die, Netflix, 17.82%

MLS:

- Sunderland ‘Til I Die, Netflix, 27.1%

- The English Game, Netflix, 25.64%

- Narcos: Mexico, Netflix, 5.04%

- Glow, Netflix, 4.38%

- See, Apple TV+, 4.16%

Nascar:

- Medal of Honor, Netflix, 7.92%

- Central Park, Apple TV+, 5.2%

- Dolly Parton’s Heartstrings, Netflix, 5%

- Truth Be Told, Apple TV+, 4.35%

- Outer Banks, Netflix, 3.29%

NBA:

- Last Chance U, Netflix, 77.61%

- When They See Us, Netflix, 57.38%

- #blackaf, Netflix, 55.73%

- Dirty Money, Netflix, 54.65%

- Narcos: Mexico, Netflix, 54.52%

NHL:

- Letterkenny, Hulu, 29.82%

- Tom Clancy’s Jack Ryan, Amazon Prime Video, 29.55%

- Medal of Honor, Netflix, 29.41%

- The English Game, Netflix, 25.95%

- Arrested Development, Netflix, 25.52%

Nielsen said, “Sports networks and brands can look to the large footprint of social affinity data between sports fans and other TV programming to identify where to place ads in the absence of live sports content … This gives marketers and brands the knowledge for more finely tuned advertising strategies based on demonstrated behaviors on social media about TV.”

The research firm concluded, “In these unprecedented times, social TV affinity data can shed light for sports advertisers and networks looking to understand the repercussions of recent cancellations on tight-knit sports communities. They can identify their super fans, keep track of these valuable groups and make sure they’re engaging authentically wherever their audiences are tuning in.”

https://www.adweek.com/digital/nielsen-tv-related-tweets-are-up-nearly-across-the-board-during-covid-19/