It’s the happiest place on earth—for advertisers, that is.

Around nine months after Disney announced ads would be coming to its flagship streaming service, Disney+ Basic launched on Thursday, giving subscribers an ad-supported offering that comes in at $7.99 per month.

Disney’s newest tier is only available in the U.S., and is expected to land in other countries next year. It offers pretty much everything that the streamer’s ad-free tier has, including the full catalog of content, multiple profiles, concurrent viewing and high-quality formats. However, features not available at launch include downloads, GroupWatch, SharePlay and Dolby Atmos.

Following Netflix debuting its Basic with Ads plan, which rolled out on an accelerated timeline and costs $6.99 per month, Adweek spent a day learning the ins and outs of the product. Now, it’s Disney+’s turn.

From signing up to the overall experience, here’s everything you need to know about using Disney+ Basic:

Signing up and bundling up

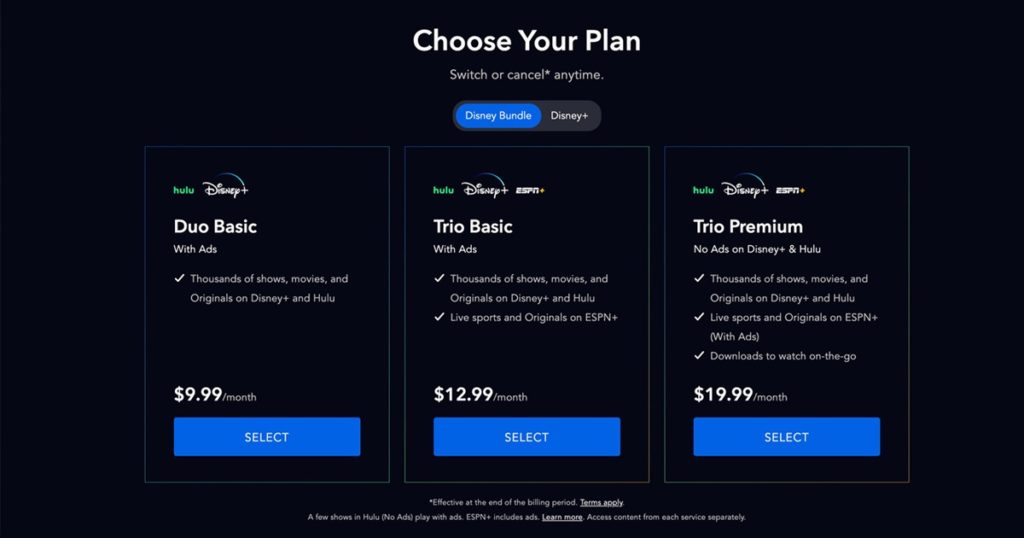

Signing up for Disney+ Basic is fairly straightforward as long as you don’t get confused by all the new bundling plan names (which include somewhat vague monikers such as Duo Basic and Trio Premium) and price hikes.

The streamer used to charge $7.99 for its ad-free tier. But now that the company has an AVOD priced at $7.99, its ad-free version has been bumped to $10.99.

Unlike Netflix Basic with Ads, Disney+ isn’t debuting with targeting capabilities, instead opting to deliver ads run of network, meaning there’s no targeting, at launch. Still, like Netflix, Disney+ collects date of birth and gender information at sign-up to use for later targeting, though the latter doesn’t necessarily need to be specified. Options include: woman, man, non-binary and prefer not to say.

The Adweek team made the decision not to give Disney+ our gender information when we made separate profiles and were able to compare the different ads we were served.

The overall ad experience

At launch, Disney+ will mostly include 15- and 30-second spots (as well as some 45-second spots depending on creative) that will air in pre- and mid-roll ads. However, Disney ad sales chief Rita Ferro recently told Adweek the company would continue testing to create the best experience for viewers, and that’s what Adweek experienced throughout using the product.

Though there were mostly 15- and 30-second ads, Adweek saw multiple 45-second ads and, surprisingly, a five-second ad for Oscar Mayer.

Our experience overall was relatively seamless with only a few minor hiccups.

The first program Adweek tried to watch on a browser crashed after a 45-second pre-roll with two spots, but upon a refresh (and needing to watch two more ads), there weren’t any other problems. In another instance, a Taco Bell ad started to play without audio before it was quickly bounced for a Pampers ad. However, these issues were few and far between.

Though there were a few exceptions, ad breaks tended to come during scene breaks and didn’t distract from the overall experience. And in addition to testing ad formats, the platform appears to be testing for the right amount of breaks.

For instance, the first 40-minute episode of Andor had a 45-second pre-roll and two one-minute ad breaks with 30- and 15-second spots. However, a similarly timed episode of She-Hulk had three pod breaks.

Shorter shows such as the animated series The Clone Wars only had a single one-minute ad break in addition to pre-roll spots.

Disney+’s goal is to have 4-minute ad loads per hour when the inventory is fully sold, but Ferro said the company intentionally undersold its inventory at launch to ensure high quality.

So while there were plenty of ads, more capabilities and larger ad loads are on the way as Disney+ builds up its audience and expands its targeting and measurement abilities.

In addition, ads can’t be skipped over or fast-forwarded, but they can be paused. You can take screenshots of ads, but not of Disney+’s content. And if a user jumps back into the episode before an ad break, they will be served more spots, even if they already went through the pod.

Brands for a brand-new offering

Disney+ Basic launched with more than 100 partners across every major holding company and more than a dozen categories, including retail, apparel, autos, financial services, restaurants, technology, telecom, CPG and travel.

Brands served to Adweek’s account included Chanel, Mercedes-Benz, Volkswagen, JC Penny, Old Navy, Pizza Hut, Visionworks, DoorDash, Chick-fil-A, Panera, Dupixent, Royal Caribbean, Westin, Sleep Number, Walmart, Fisher-Price, Olay and Aflac.

Additionally, Adweek was served several spots twice, including videos for Carnival’s Funderstruck campaign, several pieces of Eggland’s Best creative, a Dior spot featuring Johnny Depp, Nintendo Switch, The General with Shaq, Lego featuring Katy Perry, T-Mobile and more.

However, Disney is enacting a strict frequency cap for its advertisers at launch. Ferro told Adweek that Disney+ has a “more strict” frequency cap than most platforms, limiting spots to one per hour, two per day and 12 per week. This applies per user profile.

So though Adweek saw up to three spots from any one brand, there was no instance of any particular creative playing more than twice, despite watching on multiple devices from multiple locations at various times of the day.

Out of the dozens and dozens of ads we consumed, only Toyota had built-in subtitles for accessibility, which were in each spot airing from the auto company.

At launch, the company will not have competitor movie studios, network competitors, alcohol brands or political advertising on the platform.

Kids watch commercial-free

Even with no targeting at launch, audiences are still separated by 18+ and under-17. There’s also an option to create a profile for kids in “junior mode.”

Ferro told Adweek there won’t be any advertising in junior mode, and there will be no advertising in pre-school content, which proved true.

As advanced targeting rolls out, including DAR and other opportunities, those offerings will only apply to users who are 18-plus. And while profiles for those under 17 do have ads, they will remain non-targeted.

Our final thoughts

Though it’s early days for Disney+’s ad tier, the results are promising.

The tier doesn’t necessarily have the capabilities of Hulu’s ad offering at launch, but it’s easy to see those coming quickly as Disney builds up its audience. After all, Disney+’s ad tier seemed to work similarly to Hulu’s, even down to the ad pods being highlighted in yellow while commercials played.

And strict frequency caps, safety controls and a lack of ads on kids programming make Disney+ Basic accessible and usable for all ages.

Ferro previously told Adweek marketers wanted to advertise on Disney+ long before an ad tier was ever announced. So for marketers who want to be seen alongside content that includes everything from Star Wars to Marvel, Disney’s Ad-vengers have assembled a solid launch.

https://www.adweek.com/convergent-tv/our-top-takeaways-after-using-disneys-new-ad-tier/