The COVID-19 pandemic made personal computers more important than ever, and sales exploded two years in a row. But the good times for PC and chipmakers now seem to be fading fast. Last quarter’s slump in Chromebook sales has made way for an even bigger decline that’s hitting Windows manufacturers as well, and today, chipmaker Intel has revealed a 25 percent decline in consumer chip sales. It says that a “near-term cyclical slowdown” is shrinking the total market for PCs by approximately 10 percent this year.

“Some of our largest customers are reducing inventory levels at a rate not seen in the last decade,” Intel CEO Pat Gelsinger said on today’s earnings call.

Earlier this month, Gartner reported that the global PC market had already declined 12.6 percent compared to last year. And today, Apple reported a roughly 10 percent decline in its Mac sales as well, though Tim Cook suggested that it may have simply be selling out of its Mac inventory.

Back to Intel: overall, the company’s reporting a 22 percent revenue decline to $15.3 billion for Q2 2022, and its profits actually went negative — it lost half a billion dollars this quarter. That’s a 109 percent decline in profit from the $5.1 billion it saw in Q2 2021.

Intel is planning to increase the prices of its chips later this year. Might that help? The company’s data center business dropped 16 percent in revenue and 90 percent in operating income as well.

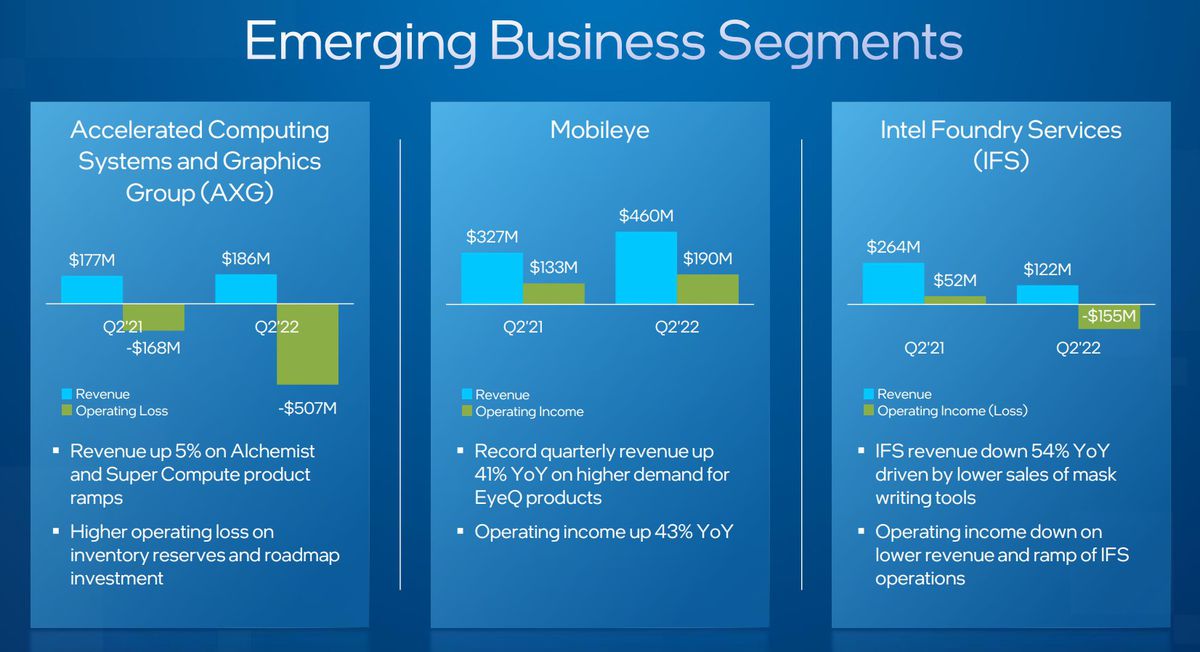

Intel’s losses aren’t all from declining sales, though. In fact, the company’s slide deck shows it lost half a billion dollars (operating loss) just to launch its underwhelming first-generation GPUs. (On the earnings call, Gelsinger says the company won’t meet its GPU target of four million units this year, but they’re track for $1 billion in revenue by year’s end, and Intel will ship the A5 and A7 Arc desktop GPUs next quarter.)

It’s also seeing a loss of another $155 million to ramp up its foundry services business, which sees the company ink deals to produce chips for other companies including Qualcomm and MediaTek. Building chips for other companies is something the company historically hadn’t done before but is part of its new plan under Gelsinger.

Rough earnings aside, Intel had a major win for that new strategy today: Congress just passed the CHIPS Act that will approve $52 billion in funding for companies to manufacture chips in the US, and it’s thought that a substantial chunk of that money will go to Intel. It seems exceedingly unlikely that the funding will actually fix the chip shortage or make the US a chip manufacturing powerhouse like its rivals in Asia, but Intel has promised (and temporarily withheld) factories and jobs based on that money. Intel says it expects to see some of that money in 2023.

Intel also revealed today that it’s exiting the Optane memory business — which it originally kept despite selling off the rest of its SSD business to SK Hynix in 2020 — and confirmed it has exited its drone business as well. Elon Musk’s brother Kimbal bought Intel’s drone light show business, The Register reported earlier this month.

Intel is forecasting lower returns next quarter as well, but CFO David Zinsner suggests things could get better from there: “We expect Q2 and Q3 to be the financial bottom for the company.”

As a point of comparison, Qualcomm reported yesterday that its phone chip business was up 59 percent this past quarter to $6.1 billion.

https://www.theverge.com/2022/7/28/23282849/intel-q2-2022-earnings-pc-industry-sales