Regions Financial Corporation’s RF subsidiary, Regions Bank, has agreed to acquire Sabal Capital Partners, LLC, a diversified financial services firm leveraging tech-driven origination and servicing platform for the small-balance commercial real estate market. Closing of the deal, expected in fourth-quarter 2021, is subject to the satisfaction of certain governmental agencies and government-sponsored enterprises’ consents as well as customary closing conditions.

– Zacks

Sabal is one of the culminating originators of the Fannie Mae and Freddie Mac small-balance commercial real estate loans, and has a strong presence in the non-agency commercial mortgage-backed securities loan origination. Sabal has originated financing worth nearly $6 billion across the United States since its inception and retains its current servicing portfolio worth $5 billion.

The acquisition does not include Sabal’s investment management business and the investment funds handled by Stone Point Capital LLC. Regions will uphold Sabal’s flagship offices in Irvine and Pasadena, California as well as New York City. When linked with Regions’ Real Estate Capital Markets’ current production offices, the consolidated platform will have 20 production offices nationwide.

While the financial terms of the transaction have not been disclosed, the acquisition of Sabal is likely to expand Regions’ real estate solutions across the full gamut of agency offerings. Regions Financial will be better poised to further build on the client base and deliver augmented range of agency as well as non-agency real estate lending options.

Sabal aids clients via the company’s proprietary avant-garde SNAP platform, a tool developed to improve the lending and communications processes with clients, and its investor base. Sabal capitalizes on tools, such as real-time commercial property financing scenarios, seamless online loan applications, and technology enabling clients, to scan loan progress through the deal’s closure.

Regions has a proven track record of delivering economical options for clients in the small- and middle-market commercial real estate space, while retaining a judicious approach to risk management. By joining forces, the companies can make a larger impact on their new and existing client base through the integration of technology-powered services, years of experience as well as strategic decision making.

Joel Stephens, head of Capital Markets for Regions Bank, said, “Sabal’s industry-leading technology platform and its leadership in the small-balance commercial real estate arena make the company a great match for Regions. Our current affordable and large-balance Fannie Mae and Freddie Mac products, combined with Sabal’s small-balance agency capabilities, will allow Regions to offer real estate solutions across the full spectrum of agency offerings. We look forward to working together to provide superior service to more real estate clients across the country.”

The acquisition boosts Regions’ strategy of acquiring businesses that facilitate it to reinforce the current client relationships, while also drawing new ones, who are attracted by the services, competencies, and technologies imparted by companies such as Sabal.

Regions continues to explore opportunities for bolt-on acquisitions, primarily in mortgage servicing rights, and adding capabilities in the wealth management unit. Last month, Regions Bank’s Real Estate Capital Markets division became an approved Freddie Mac Multifamily Conventional and Targeted Affordable Housing Optigo lender. The latest approval further enhances the company’s lending suite within its Capital Markets division.

The company is also currently working on a digital advisory solution, which is likely to be deployed in late 2021 or early 2022. As it is committed to diversifying its revenue streams and meeting customer needs through diverse services, we believe such endeavors will support the company’s growth prospects over the long term.

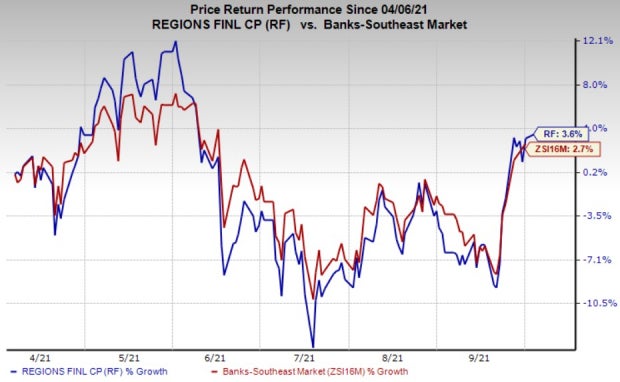

Shares of Regions have gained 3.6% in the past six months, outperforming 2.7% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Similar Expansion Efforts by Other Banks

At present, banks have resorted to mergers and acquisitions to dodge the heightened costs of investments in technology and counter lower rates.

Recently, U.S. Bancorp USB had entered into a definitive agreement to acquire MUFG Union Bank’s core retail banking operations from Mitsubishi UFJ Financial Group MUFG for a cash-and-stock transaction valued at $8 billion, in a bid to boost its presence on the West Coast. The deal’s closure, expected in the first-half of 2022, is subject to the satisfaction of customary closing conditions and regulatory approvals. No shareholder approvals are required from both companies.

Southern Missouri Bancorp Inc. SMBC announced that it will acquire Fortune Financial Corporation in a stock-and-cash transaction worth $30 million.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF): Free Stock Analysis Report

U.S. Bancorp (USB): Free Stock Analysis Report

Valley National Bancorp (VLY): Free Stock Analysis Report

Southern Missouri Bancorp, Inc. (SMBC): Free Stock Analysis Report

Mitsubishi UFJ Financial Group, Inc. (MUFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/389496