Regulators are considering a breakup of the Google empire including a forced sale of its dominant web browser Google Chrome and certain aspects of its ad-tech stack.

A Politico report cites several sources with knowledge of the discussions taking place as the U.S. Department of Justice and several state attorneys general prepare to file suit against the online behemoth.

Official proceedings are expected to take place within weeks, following months of speculation over how government officials intend to rein in Google’s dominance of the $130 billion a year online advertising business—of which Google controls 37.2%.

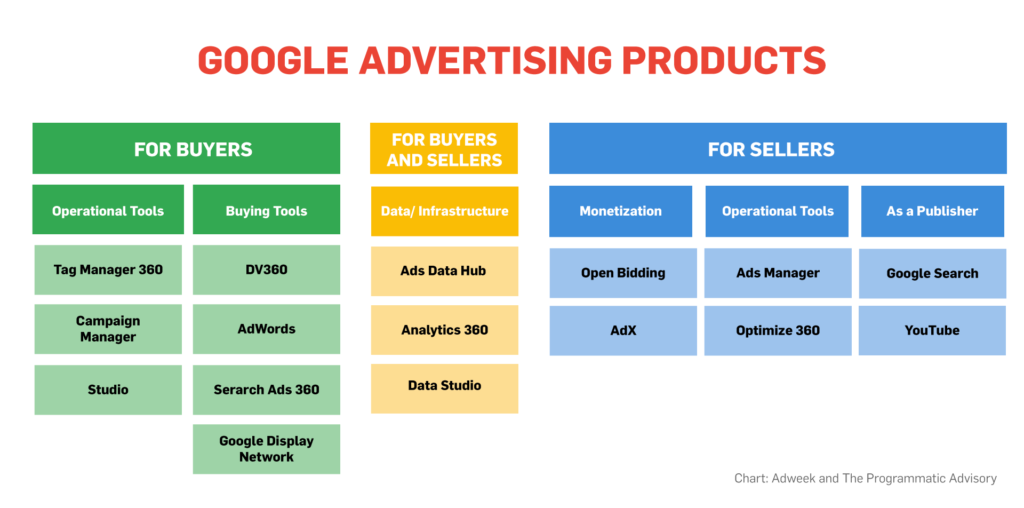

Google Chrome commands a 66.3% global market share, according to GlobalStats. Its ad stack, popularly referred to as DoubleClick, comprises both buy- and sell-side tools as well as its dominant ad-serving tool.

This set of tools, as well as Google’s “closed” operating model, has prompted many to accuse Google of exerting undue control over all aspects of the online advertising market (see video below), and its 2015 decision to block third-party ad-buying tools from purchasing ad space on YouTube was widely criticized.

Google is also navigating a potential political minefield of deprecating third-party cookies in Chrome, a move that could obliterate the efficiency of third-party programmatic players in the web browser.

Politico reported the latest discussions are separate from the DOJ’s efforts to tackle Google’s dominance of the search engine market, an intervention many expect as soon as next week.

The latest media reports come within a week of the House Judiciary Committee’s Subcommittee on Antitrust publishing a 449-page report roundly criticizing Amazon, Apple, Facebook and Google.

Among the recommendations in the report were that authorities impose “structural separations,” either by way of a forced sale of certain parts of each company’s assets or assurances parts of their businesses are firewalled. Other recommendations included rules to prevent “self-preferencing,” plus the promotion of “interoperability” with third parties and an overhaul of M&A laws.

Speculation over the DOJ’s investigations has been mounting since early 2020. Google appointed Halimah DeLaine Prado as its general counsel in August, and Attorney General William Barr has taken a keen interest in the case.

Adweek sources, several of whom have consulted the DOJ as part of its investigations into Google’s dominance of the online ad market, praised the depth of research in the recent congressional report.

However, some question whether politicians will ever be able to match the technical sophistication of Big Tech’s engineers when it comes to effective oversight of any self-imposed limitations proffered by Google.

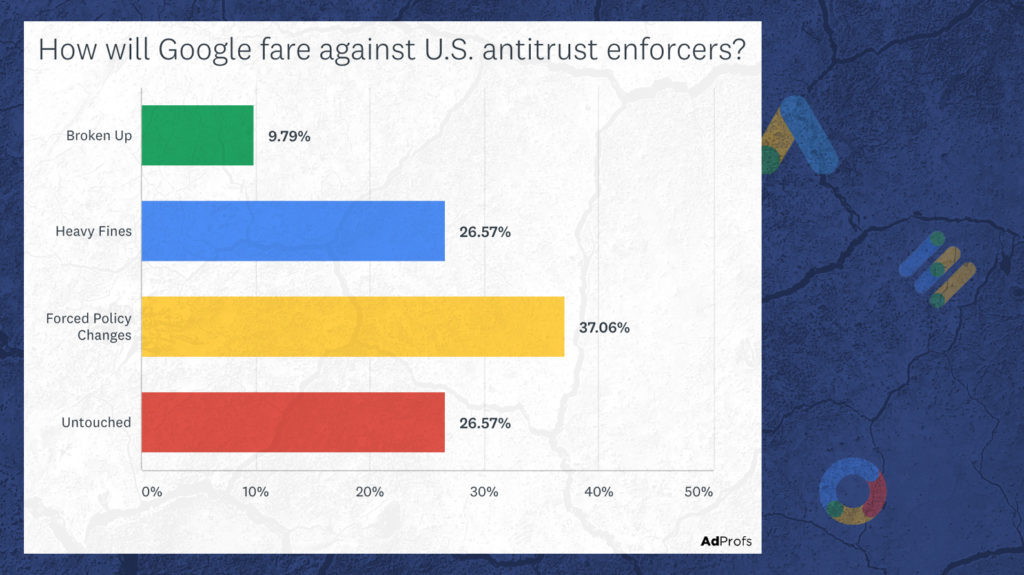

Earlier in the year, a poll of 143 ad-tech experts by consultancy firm AdProfs found that only a quarter of participants thought Google would voluntarily divest some of its assets and that it would more likely propose limitations to how its ad stack operates.

Speaking at Adweek’s virtual NexTech conference on the same day the CEOs of Amazon, Apple, Facebook and Google were appearing before the congressional subcommittee behind last week’s report, professor Scott Galloway said, “They need to be broken up.”

“I think you have to sell the old DoubleClick unit,” Galloway said, “and I realize that’s untangling some spaghetti, and I think you have to spin [off] YouTube. … I just think their engineers are smarter than our regulators.”

Google’s olive branch

Last week’s congressional report criticized the outsize effect Big tech had on traditional publishers given their increasing dominance of advertisers’ budgets.

https://www.adweek.com/programmatic/regulators-reportedly-mull-forced-google-chrome-sale/