Opinions expressed by Entrepreneur contributors are their own.

Grow fast or die is in the DNA of many startups . The risk of failure is very great and it seems that there are no middle terms, or you succeed or fail big.

Companies that move beyond the early stage and consolidate a proven and scalable model ( scaleups ) seem to have reached maturity, although the hunger to grow may lead them to evolve their entrepreneurship into a mythical animal: a unicorn .

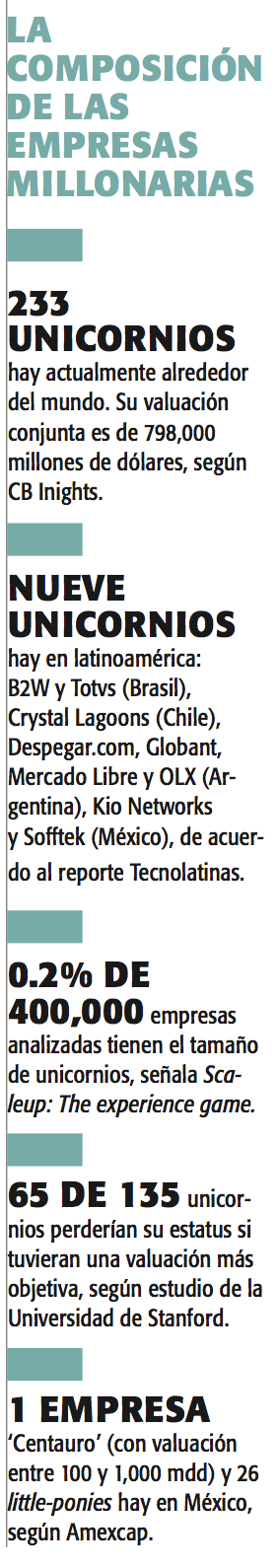

Very few startups make it to this stage, only 0.2% make it, according to a Deloitte study, but new unicorns keep appearing and investors seem comfortable with the risk. But should it be a goal for scaleups to become unicorns? What do they need to achieve it?

What is a unicorn?

There are two main characteristics that define unicorn companies: first, they are private companies, and second, they have a valuation of more than $ 1 billion. And there are companies worth tens of billions. The two quintessential unicorns are Uber ($ 68 billion) and Airbnb ($ 29.3 billion).

These two companies, in addition to their high valuation, have two things in common: they are technology startups and do not have physical assets; Uber is a massive transport platform but does not own a single vehicle, while Airbnb is a hospitality service in several countries but does not have any bed or hotel.

If unicorns have no physical assets and are not public companies (and sometimes they don’t even make a profit), why do they get such high valuations? Growth expectations and return promises make investors risk capital in high-risk ventures, but with aggressive growth.

How is the proccess? A startup participates in several financing rounds. These rounds consist of selling stocks to raise money and arrange different agreements with investors. For example, investor A can promise a return of 1.5 times his investment, while investor B can be left with a return of 2.0 times.

A unicorn has up to eight different classes of shares for various types of investors, from employees to venture capital funds. The valuation is based on the last price of each type of share in the last round of financing.

“Some unicorns have made such generous promises to their preferred shareholders that their common stock is almost worthless,” says Ilya Strebulaev, a professor of finance at Stanford University, in a study published in March 2017.

These promises of payment cause companies to achieve valuations without a real basis to support them. The Stanford Business School did an exercise evaluating various unicorns with a method closer to reality. For example, Kabbage, a Fintech startup, is valued at $ 1 billion, but with Professor Strebulaev’s method it would cost only $ 400 million, 138% less.

But these delusional valuations do not inhibit investors from seeking more unicorns. In September 2015, CB Insights had detected 131 of these mythological startups with a combined value of 488,000 million dollars. Now the analytics firm identifies 228 companies with a combined value of 790,000 million.

Most unicorns are found in the United States (113), China (62), the United Kingdom (13) and India (10), according to data from CB Insights.

Scaleups Vs Unicorns

50% of startups fail before their fifth year of revenue, according to a Deloitte report published in 2015, in which it analyzed data from 400,000 companies. Of the survivors, only one in 200 will ever become a scaleup, so becoming a unicorn is truly unlikely.

But this does not mean that you fail if you do not reach a valuation of $ 1 billion. The scaleups, with a more stable growth, are considered companies that can add a lot of value to the ecosystem and generate jobs.

A scaleup, according to the Organization for Economic Cooperation and Development (OECD), is a company with growth of more than 20% in its business in its first years (they grow more than 10 million in the fifth). They don’t have the speed or size of a unicorn, but they add value, are more patient, and have a scalable business model.

“To be considered an accelerated growth company, its progress should be at least 20%”, confirms Jorge González, director of G2 Consultores.

Almost all unicorns target large, homogeneous markets, launch products with high “must have” appeal that are easily accessible (eg mobile-based) and require frequent use, preferably several times per year. That is the case for Uber and Airbnb, but it is also the case for other companies that are already public, such as Facebook and Twitter.

In contrast, a scaleup’s business is based on business-to-business (B2B), takes longer for the model to mature, but is scalable in various sectors, such as software, online services, media and entertainment formats and content, electronics, infrastructure and energy, indicates Deloitte in the study Scale-Up: The experience game.

The next unicorn

The professional services firm highlighted that among the 400,000 companies analyzed, only 104 startups had a value greater than $ 1 billion. That is, only 0.026% had this level.

Becoming a unicorn is literally fighting all the odds. In 2015, the firm CB Insights foresaw that 3D Robotics, the drone manufacturer co-founded by the Mexican Jordi Muñoz, was going to become a unicorn. Now the company struggles to stay afloat and find its position in the market. On the other hand, DJI, its fierce competitor from China, is valued at $ 10 billion and dominates the segment.

There are currently two Mexican companies that would fit into the unicorn classification, Softtek and Kio Networks, both providers of technology services, are private companies with a valuation of more than $ 1 billion, according to the Tecnolatinas report.

Another seven companies in this region of the continent would meet the status of unicorns, according to the study.

Beyond the dream of raising capital in Silicon Valley to the point of being a unicorn, there are more opportunities for startups to become scaleups, although there is still a lack of further development in the country’s entrepreneurial ecosystem, considers Jorge González, from G2 Consultores.

What is needed

If you want to go from scaleup to unicorn, what companies must consider is that they must maintain the spirit of a startup and embrace risk.

“You have to ask yourself how much you have to invest, what other products can be developed, what companies have to buy, what technologies to adopt to grow at an accelerated rate,” adds González.

The specialist warns that when companies reach a considerable size and a stable income level that gives the founders a good life, they become less risk-tolerant and see their company as a ‘Cash Cow’ that must be taken care of so that he does not stop giving money.

“There must be a hunger for growth. Keep thinking like a Startup, reinvent yourself and be more aggressive in the market ”.

This does not mean jumping into the void and losing what has already been gained, but rather a diversification strategy, finding partners that can finance aggressive growth, such as Private Equity funds, can help the company not be totally unprotected in its transformation into a unicorn. .

Growth examples

In 2017, the number of reservations in Mexico through Airbnb grew 165%, which makes this market one of the most attractive for the unicorn specialized in accommodation. But the company’s strategy is not focused on reservations, rather they want to be present throughout the travel chain.

As of last June, the company began with Experiences, an option that travelers can choose from tours, tastings or dynamics offered by the hosts themselves. There are currently more than 90 Experiences available in Mexico City.

Offering more services through the platform is one of the ways the app keeps growing to deliver on its promises to investors.

You can also learn from companies that have been public for years, but still maintain the spirit of Startups.

Amazon, owned by Jeff Bezos, the richest man in the world, did not settle for just being a bookstore, it expanded the business towards the delivery of products and now enters other sectors, such as supermarkets, after the purchase of Whole Foods, the opening of a supermarket without cashiers and the possibility of entering directly into the FedEx and UPS market to become another logistics and parcel firm.

Jorge González from G2 consultores is forceful in this regard, “Alphabet [the American multinational whose main subsidiary is Google, which develops products and services related to the Internet, software, electronic devices and other technologies] puts money in very embryonic, very aggressive projects. They have the vision of always really looking for more. The startup spirit is never lost ”.

https://www.entrepreneur.com/article/372163