Until COVID-19 hit, location data was being used by marketers for real-world audience insights and online-to-offline attribution. And while smartphone data has gotten attention as part of “contact tracing,” one could assume marketing use cases for location data have all but disappeared.

What consumers are actually doing. But that’s definitely not the case. Many marketers are using location data for real-time insights about what consumers are doing on the ground — literally. Surveys reflect attitudes, hopes and fears. But behavior is often different.

As a basic matter, “You can see how people actually responding to the guidance they’ve been given,” observes Duncan McCall, CEO of PlaceIQ. “Are they going out, are they staying home?”

“There’s a surprising amount of movement going on out there,” he says. “Because there’s essentially no federal guidance, as in Europe, local markets look very different.” That’s especially true now that more than 30 U.S. states are relaxing lockdown restrictions in uneven ways, while others are being more cautious.

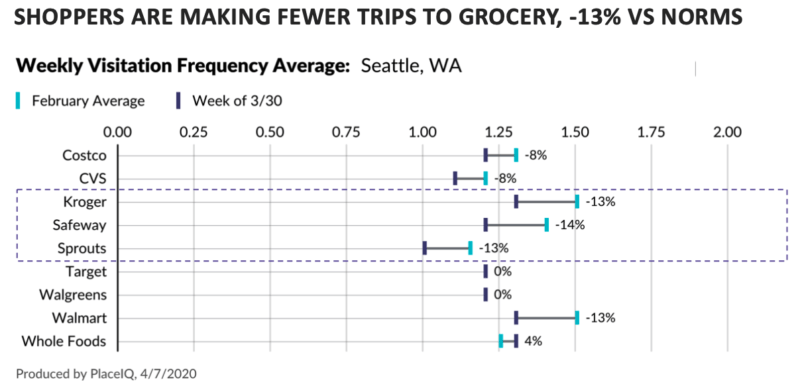

I asked McCall what kinds of patterns or trends he had observed during the lockdowns. He quickly rattled off a few examples. He told me, for one, “People are making fewer trips to the grocery store but they’re staying longer each time.” He also said people are going to different markets than they might have before, because of convenience, crowds or wait times.

Fundamental behavior changes on display. McCall also said that among the major fast-food chains, foot traffic had dropped to all of them except Sonic, because it doesn’t have a dine-in business; it’s all drive through. Another quarantine use case, for retailers, looks at past store visits to identify loyal customers for retargeting or email messaging, to prevent leakage.

Location data can equally be used to drive online sales. McCall pointed to an earlier case study involving retailer Urban Outfitters in which PlaceIQ was able to locate specific buyer personas through real-world behavior and then work with a partner to reach those people online to deliver e-commerce (rather than in-store) sales.

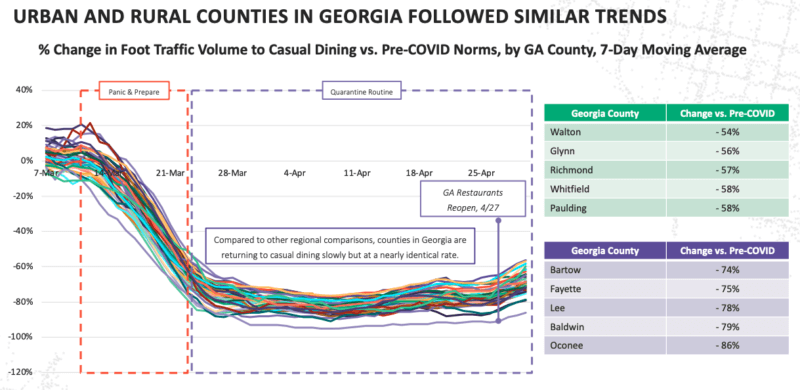

“People’s behavior has been fundamentally changed [by COVID-19] in multiple different ways,” McCall says. “Location data allows you to understand on a daily basis, how that behavior is changing and how it’s different in different cities and regions.”

The value of this kind of insight is self-evident as local economies open in non-uniform ways. Are people going back into businesses, restaurants and retailers, and who’s actually showing up? Marketers can make assumptions based on past data but they may no longer apply.

“You’ve got to use data and tools to understand your customers,” McCall says. “This is going to force everybody to be smarter.”

Why we care. In a downturn new buyer segments often emerge. They can be more aligned with economic self-confidence or caution rather than traditional demographics. However, in the U.S., region, age, race, politics and class will all factor in near-term consumer behavior, as America moves ahead with reopening.

Location data can be an indispensable tool in understanding how customers and prospects are behaving in this highly unpredictable environment. On this Friday’s Live with Search Engine Land, I’ll be exploring these topics in more depth and detail: What is location data telling us about consumers and the potential for recovery?

http://feeds.searchengineland.com/~r/searchengineland/~3/VLhhVwkVt7A/stores-have-been-closed-so-location-data-isnt-relevant-right-wrong-334562