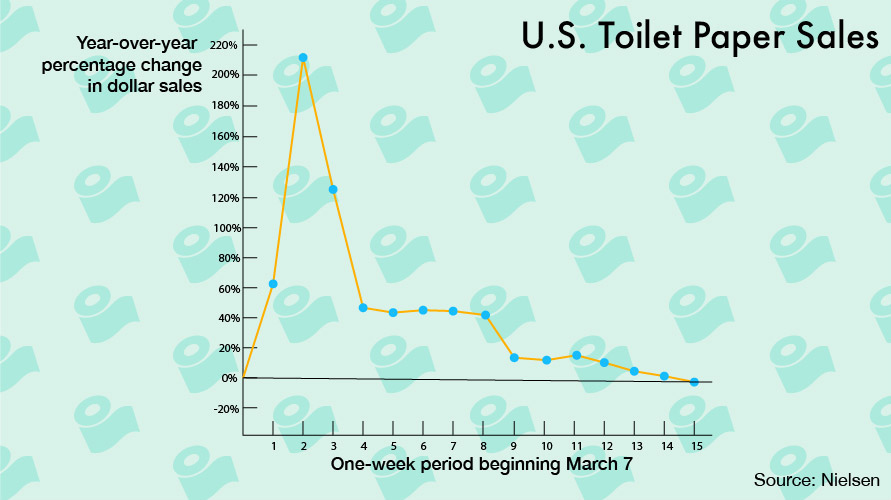

Ever since the pandemic set off a national wave of panic buying, few items have served as a better indicator of consumer fear and anxiety than toilet paper. But new sales numbers suggest the nation’s concerns are abating.

For the first time since the Covid-19 outbreak, in-store U.S. sales of toilet paper dipped lower than they were during the same period last year. For the week ending June 13, year-over-year sales of toilet paper were down 0.6%, according to Nielsen.

Figures show that demand for toilet paper spiked in mid-March when year-over-year sales were up 216.8%. Following weeks of slowing growth, sales fell into negative territory for the first time last week.

In the U.S., figures from Euromonitor International show that the toilet paper market is dominated by three companies: Procter & Gamble, Kimberly-Clark and Georgia-Pacific. All three have benefited during the pandemic, with year-over-year toilet paper sales ultimately up 45.8% for the 15-week period ending June 13, according to Nielsen. (Although Nielsen also tracks online sales of toilet paper, those numbers weren’t included in this analysis.)

In late March, Kimberly-Clark’s Cottonelle brand discouraged consumers from hoarding toilet paper in an ad campaign called “#ShareASquare.” “Instead of stockpiling toilet paper, let’s stock up on generosity,” reads a line from the 30-second spot.

On a broader scale, Americans are still dedicating more dollars toward consumer staples than they were last year. In May, household spend on consumer-packaged goods was up 21% compared to May 2019, according to NCSolutions, a CPG measurement insights company. At the same time, that’s lower than it was in April (up 29%) and March (up 36%).

Some experts expect to see elevated demand for consumer-packaged goods for years to come—or at least as long as people spend increased amounts of time at home.

And at home they might stay. A new survey from S&P Global Market Intelligence found that 67% of organizations that have implemented or expanded work from home policies in recent months expect these policies to remain in place either permanently or for the long term.

https://www.adweek.com/retail/toilet-paper-sales-finally-drop-for-the-first-time-since-lockdown-began-in-the-us/