What a difference a single year can make. Now that most of the pandemic-related restrictions have been lifted across the country, investors have been aiming to take advantage of stocks that stand to benefit from the economic reopening. Whereas last year witnessed a surge in many of the ‘stay-at-home’ names, the beginnings of a return to normalcy have coincided with a surge in industries that were decimated last year.

– Zacks

Gyms were certainly one of the hardest hit businesses in 2020, and it’s easy to understand why that was the case. Their monthly revenues disappeared overnight as gyms were forced to freeze memberships at no cost to the consumer.

Social distancing and other restrictions that were imposed upon the public left zero chance of getting a workout in at the gym for a solid four months in most states. And even when gyms were permitted to reopen, many members were extremely hesitant to return. A survey conducted by Statista Global Consumer showed 46% of respondents were very uncomfortable going back to the gym in the latter half of 2020.

As such, people turned to exercise at home, which led to well-known names like Peloton PTON and Nautilus NLS skyrocketing in 2020. Last year, it seemed like everyone was buying a spin bike to use in the comfort of their home (I know one ended up in mine). While both Peloton and Nautilus had a stellar 2020, we can see in the chart below that these ‘stay-at-home’ names have reversed course this year, while the more traditional Planet Fitness has held up well.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Every fitness advertisement last year claimed that the industry had been changed forever. Yet just like many major cities have seen numbers come roaring back after an initial scare, gyms are also seeing members return. This is an industry that has truly completed the roundtrip.

People are going back to the gym. And while it’s certainly convenient to workout in your own residence, there is simply no getting around the fact that gyms have a much wider array of machines and equipment to help keep people in shape – not to mention extra amenities such as pools, spas and other luxuries.

Let’s take a look at three stocks that stand to benefit from the continued economic reopening.

Lululemon Athletica (LULU)

One could argue that Lululemon has created its own specific niche within the fitness industry. Last year, LULU acquired Mirror, the smart at-home workout machine founded by Brynn Putnam. And while it has been touting Mirror in much of its marketing, the company has built a devout following over the years for its athletic apparel and yoga-related products.

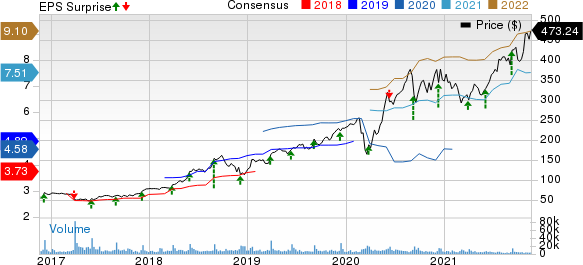

Currently sporting a Zacks #2 Buy rating, a return to the gym has undoubtedly provided a boost to LULU’s core business. The company has seen a rebound in brick-and-mortar sales driven by an increase in store traffic as consumers have become more comfortable shopping in store. In the second quarter, traffic trends increased by over 150% compared to last year. LULU most recently reported an EPS beat of $1.65 back in September, delivering a 36% surprise over consensus and 123% growth over the same quarter in 2020.

lululemon athletica inc. Price, Consensus and EPS Surprise

lululemon athletica inc. price-consensus-eps-surprise-chart | lululemon athletica inc. Quote

The company is part of the Textile – Apparel industry within the Consumer Discretionary sector. This industry currently boasts a Zacks Industry rank of 66, which puts it in the top 26% of all 253 industries.

LULU’s next earnings report is slated for December 9th. Management remains upbeat and earlier this year raised its outlook for fiscal 2021. LULU’s current full-year Zacks Consensus Estimates are anticipating earnings of $7.51 per share, which would represent a nearly +60% change year-over-year.

The company’s solid financial footing and strong business momentum should serve it well heading into next year.

Dicks Sporting Goods (DKS)

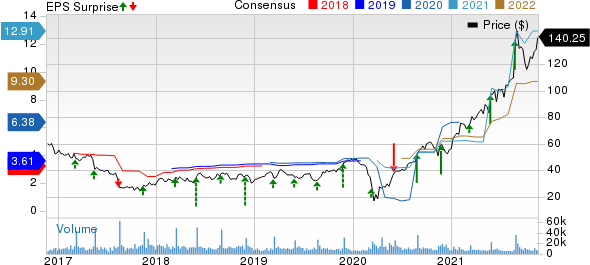

Currently holding a Zacks #3 ranking, DKS stock has been on a tear this year. It has advanced over 160% and is showing no signs of slowing down. The company is on a hot streak in terms of EPS surprises. In each of the last three quarters, DKS has handily beat estimates with an average EPS surprise of over 118%. It most recently reported earnings back in August of $5.08 per share, up 58% from the prior year quarter and a surprise of over 81% compared to the $2.80 consensus.

DICK’S Sporting Goods, Inc. Price, Consensus and EPS Surprise

DICK’S Sporting Goods, Inc. price-consensus-eps-surprise-chart | DICK’S Sporting Goods, Inc. Quote

The sporting goods retailer is witnessing increased demand from the economic reopening, which has translated into more consumer purchases for its athletic shoes, apparel and other accessories. Solid Q2 results were driven by an increase in net sales of 21% year-over-year and double-digit sales growth in its core categories – hardlines, apparel and footwear.

DKS management revised its fiscal 2021 guidance earlier this year. Same-store sales are likely to grow 18-20%, up substantially from the prior 8-11%. Adjusted earnings are expected to be in the range of $12.45-$12.95, reflecting a drastic improvement from the $8-$8.70 previously expected.

The company is part of the Retail – Miscellaneous industry group, which ranks 106 out of all 253 industries, putting it in the top 42%.

Zacks full-year current consensus estimates are sitting at $12.91, which would represent an increase of nearly 111% year-over-year. DKS is due to report quarterly earnings next Tuesday, November 23rd. The consensus estimate has been revised upward by 3.3% in the past 30 days.

What the Zacks Model Reveals

The Zacks Model predicts an earnings beat for DKS for the upcoming earnings announcement. The combination of a positive Earnings ESP (Expected Surprise Prediction) and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) increases the chances of an earnings beat. The Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. DKS currently has an Earnings ESP of +27.97%.

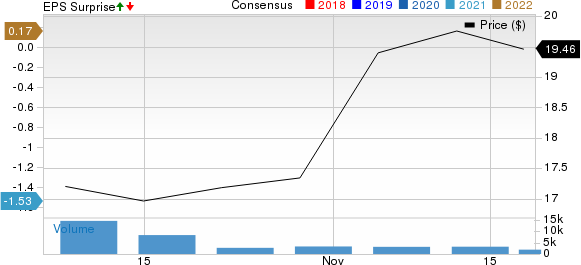

Life Time Group Holdings (LTH)

Life Time, currently a Zacks #3 Hold, is a leading lifestyle brand offering premium fitness, wellness and health experiences to over 1.4 million individual members. The company was founded nearly 30 years ago and is headquartered in Chanhassen, Minnesota. Life Time operates over 150 fitness centers across 29 states as well as a Canadian location.

Prior to the pandemic, the company generated $1.9 billion in revenue in 2019, with $438 million in Adjusted EBITDA and $30 million in net income. While a COVID-related downturn was expected for the company in 2020, LTH has seen a strong rebound in 2021. The company has also invested in multiple lucrative partnerships, including an agreement with Apple to provide Apple Fitness+ to their members.

LTH recently enjoyed its IPO back in early October. The company has since reported that Q3 revenue was up 66.7% to $385 million and comparable center sales were up 58.7%. These results were achieved with nearly 20% of LTH’s centers still experiencing pandemic-related restrictions during the quarter. The stock is currently about 10% from its initial $18 IPO price.

Life Time Group Holdings, Inc. Price, Consensus and EPS Surprise

Life Time Group Holdings, Inc. price-consensus-eps-surprise-chart | Life Time Group Holdings, Inc. Quote

On a personal note, I’ve been a Life Time member for many years and have been continuously impressed with their services. Having frequented several well-known gyms, I can definitively say that LTH’s luxurious fitness centers are some of the best in the business. The company’s handling of the pandemic and the procedures it implemented with regards to social distancing, cleanliness and safety were second to none.

The staff does an incredible job and I can tell that this is a well-run company. It will be interesting to see how the stock performs moving forward. LTH is scheduled to report earnings on January 27th, 2022.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DICK’S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

Nautilus Group, Inc. The (NLS): Free Stock Analysis Report

Peloton Interactive, Inc. (PTON): Free Stock Analysis Report

Life Time Group Holdings, Inc. (LTH): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/398352