Key Insights:

In June, the Association of National Advertisers called for a “transformative shift” to the upfront as the novel coronavirus pandemic sent TV’s long-standing ad-buying process into upheaval.

On Wednesday, Marc Pritchard, chief brand officer of Procter & Gamble, the world’s largest advertiser, said the upfront process is “antiquated” and makes little sense for marketers.

But that isn’t an immediate death knell for the upfront. Instead, the 60-year-old way of reserving TV ad space is modernizing.

“The upfront model is changing,” said Kari Marshall, vp of media at T-Mobile, during an Adweek webinar on Wednesday. “I still think that there is value in an upfront type of model. … I think that the evolution of the upfront is just transacting on a different set of inventory, versus the whole thing.”

The upfront still provides value. Media owners can put revenue on the books, which helps appease investors and fund new and returning programs. Brands and agencies get discounts on valuable programming that would otherwise be unavailable or more expensive in the scatter market.

But the process is rigid, since advertisers often have to take on packages of content when they just want to buy specific programs their target audience watches.

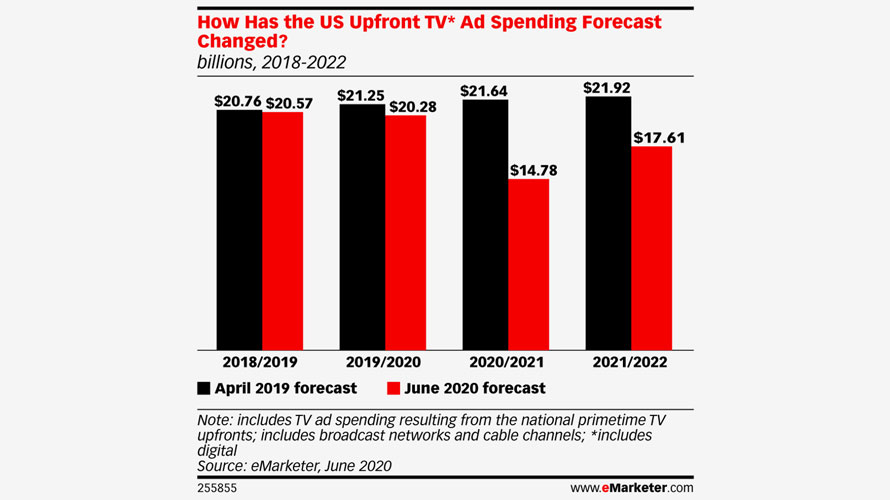

The pandemic has accelerated calls for more flexibility in upfront buys, which are on track to dramatically fall. U.S. upfront TV ad spend is forecasted to decline 1.4% this season to $20.28 billion, and drop by 27.1% in the 2020-2021 season to $14.78 billion, according to research firm eMarketer.

It can be hard for advertisers to find shows that over-index to their target audience—diamonds in the rough that can be bought for cheap but reach the exact right viewers.

Pritchard described this as “information asymmetry” where “whoever has the most information has an advantage. And year in, year out, the media providers have ‘information asymmetry.’”

To level the playing field, advertisers are consolidating their buying teams and partnering with tech platforms to get a better understanding of who their target audience is and how to efficiently reach them.

Charlie Chappell, head of media at Hershey’s, said during the webinar that one of the company’s biggest areas of investments is in integrated media management. This helps each Hershey’s brand team manage campaigns across linear, digital and even retail media.

“We have to look at it even more holistically than we ever had before. We’re really building … to be able to put that whole integrated plan together [and] look at a lot of the different data signals to determine what optimizations and changes we should make,” said Chappell.

Data-driven doesn’t mean real-time bidding

Because there’s a scarce amount of TV inventory, advertisers will want to buy big programs, like sports and news, upfront. But more advertisers are coming armed to negotiations with data to start trading on audiences at advantageous rates.

“Instead of just your buying volume being where the clout comes in, it’s how good you are with data that becomes a new advantage,” Aaron Goldman, Mediaocean CMO, told Adweek.

An upfront package can include a range of inventory, including national buys, addressable linear, connected TV and other digital video offerings.

Some of that inventory, especially the fast-growing and internet-enabled CTV category, can be transacted programmatically, resembling mobile and desktop advertising. But major advertisers have set rates with networks, so moving to the biddable environment of a real-time ad auction likely means their low prices would skyrocket.

https://www.adweek.com/programmatic/the-upfront-isnt-dead-yet-but-its-getting-more-data-driven/