Finance needed a makeover, a reinvention. For younger generations—or even for older generations—finance is the topic that makes you very stressed. There are a lot of financial education apps that help you manage your money or grow your money. They’re great products—they’re just not built by Latinos.

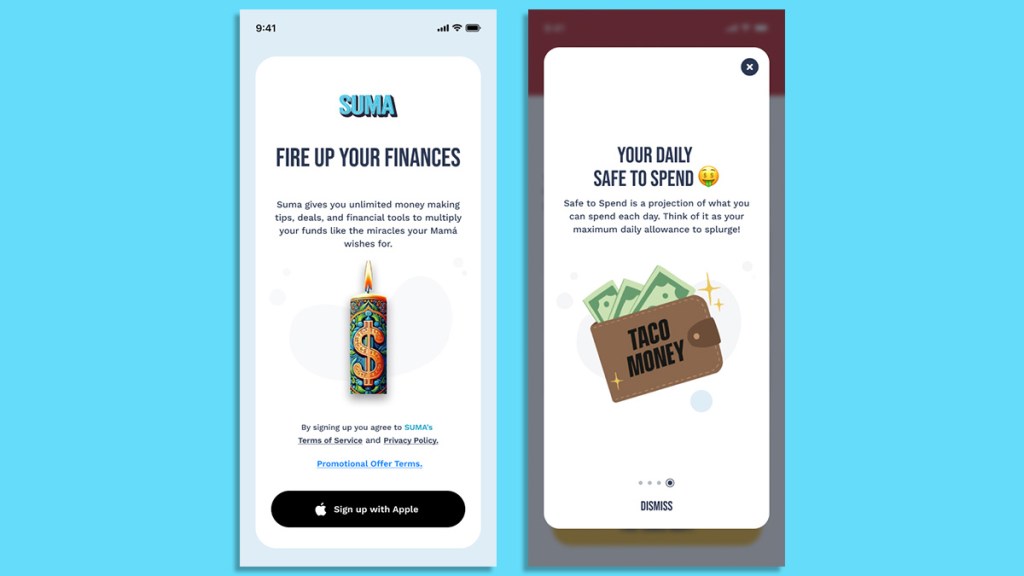

I don’t want to dismiss my other CEO colleagues who run fintechs, but they tend to be focused on language. There’s a huge demo that is only Spanish-speaking; they’re older, they’re immigrants, etc. I wanted to focus on the youth—the impact is greater. That’s the key to moving the needle on closing the wealth gap. So [finance] had to be reinvented. It couldn’t be boring. It couldn’t be daunting. It needed to be culture first.

I was scared to death—I enrolled in every single class. Fintech [at] Harvard, Stanford, Berkeley, Wharton; I was studying day and night, weekends, slept like for two hours [because I was just] absorbing everything. I said, I’m not going launch this and then be a fake; I was super privileged and lucky that a few investors [were interested], particularly female investors.

If this really scales, this means we’re going to make a massive impact on the community’s wealth. That excites me so much. I feel like I could die in peace.

The key to the next generation

It was a shock to me when I built Suma and tried to understand that the young generation, [who were] U.S.-born and spoke English, felt like “ni de aqui, ni de alla” [from neither here nor there]. Here they’re “not American enough.” When they go back to visit their parents’ countries of origin, they don’t speak perfect Spanish. They’re almost in no man’s land.

The moment you start speaking English, you are responsible for translating at the doctor, [for being] the legal person, etc. Navigating the American ethos, literally and figuratively, is what we do as Sherpas or navigators.

The youth that we serve today at Suma is managing the finances for three other family members, who tend to be older and Spanish. Being a sandwich generation puts a lot of stress on younger kids in our community, because they are responsible for their parents or responsible for their kids as they become parents themselves. And it’s really hard. Our parents did not plan for retirement. Or [there is this] perception that whatever [mom] had saved, she gave to her parents [and we are expected] to do the same. It’s a cycle of “you are my 401K.” So, when are we going to be able to build a generation of wealth if we’re always sort of catching up with whatever small wealth we build?