Tilray, Inc. TLRY will release financial results for the first quarter of fiscal 2022 (ended Aug 31, 2021), before market open on Oct 7.

– Zacks

Let us see how things have shaped up prior to this announcement.

Factors at Play

Tilray is a leading global cannabis-lifestyle and consumer packaged goods company.

In May 2021, the company completed its previously announced business combination with Aphria. Each Aphria shareholder received 0.8381 of a Tilray share for each Aphria common share held on Apr 30, 2021. The consolidated entity is now one of the leading cannabis-focused consumer packaged goods companies with the largest global footprint in the industry.

Revenues increased 25% in the fourth quarter of 2021, driven by 36% growth in net cannabis revenues. The same trends are likely to have prevailed in the fiscal first quarter.

Tilray has been gaining market share nationally in Canada month over month since April 2021. The combination with Aphria strengthened its infrastructure with the addition of SweetWater, a leading cannabis lifestyle branded craft brewer.

In July 2021, SweetWater announced the launch of 420 Imperial IPA, the first-line extension off of its flagship 420 brand. In the same month, the company announced the completion and shipment of the first successful EU GMP-certified medical cannabis harvest grown in Germany for German distribution. In June 2021, Tilray announced unveiling the medical cannabis brand Symbios.

These factors are expected to have driven revenues in the quarter under review.

The new company expects to generate approximately $80 million of annual cost synergies within 18 months and plans to achieve cost synergies in the key areas of cultivation and production, cannabis and product purchasing, sales and marketing, and corporate expenses. To date, Tilray has achieved $35 million worth of synergies.

Earnings Whispers

Our proven model does not predict an earnings beat for Tilray this reporting cycle. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Tilray has an Earnings ESP of +35.72%.

Zacks Rank: Tilray currently carries a Zacks Rank #4 (Sell).

Share Price Performance

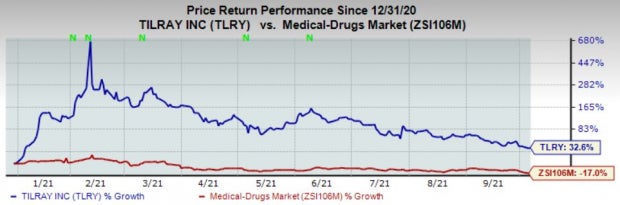

Tilray’s stock has surged 32.6% in the year so far against the industry’s decline of 17%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stocks to Consider

Here are a few stocks worth considering as our model shows that these have the right combination of elements to beat on earnings this season.

Pfizer PFE has an Earnings ESP of +5.07% and a Zacks Rank #2, currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

GlaxoSmithKline GSK has an Earnings ESP of +2.52% and a Zacks Rank #3 at present.

Merck MRK has an Earnings ESP of +5.51% and a Zacks Rank of 3 at present.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Tilray, Inc. (TLRY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

https://www.entrepreneur.com/article/389499