If it feels as though commercials from the likes of Warby Parker, Casper and Dollar Shave Club are appearing less than they did prepandemic, there’s a reason.

TV ad spend among top direct-to-consumer (DTC) brands is down 48% when comparing Q2 2020 with Q2 2019, according to a new report from TV measurement company Alphonso, which gets its data from 15 million households. According to Allen Bush, Alphonso’s chief marketing officer, uncertainty caused by Covid-19 is the likely culprit.

“The spend dropped at the first of April, just after shelter-in-place orders became ubiquitous across the country,” he said.

With the unemployment rate improving—yet still high—at 8.4%, people aren’t as likely to make purchases beyond the basics. A recent survey from Kantar revealed that 73% of global consumers say the coronavirus crisis has either already negatively impacted their household income or they expect it soon will.

Canceled sports games, a decline in scripted shows due to production shutdowns and brands hitting pause on their TV presence in the early days of the outbreak has all hurt the TV industry. In April, eMarketer estimated that TV ad spend would decrease between 22.3% and 29.3% in the first half of 2020, amounting to a loss of between $10 billion and $12 billion.

The sudden change in TV scheduling has also presented an opportunity for those looking to run commercials because fewer buyers means more inventory is available. And while the cost of placing an ad in top-tier programs is largely set, the price for substitute programming is lower.

In June, DTC men’s apparel brand Mack Weldon began broadcasting TV ads for the first time in its nearly 10-year history. The company decided to test linear television “given that costs have gone down in that world,” said CEO Brian Berger.

The sweet spot to experiment with the medium, however, is quickly closing. Sports and fall lineups are returning, bringing major advertisers with them. Plus, demand for airtime during an election year tends to drive rates up, especially with November just over a month away.

On a wider scale, Magna Global, the media strategy arm of IPG Mediabrands, forecasts that the global ad market will amount to $647 billion by 2021, down from a previous estimate of $745 billion.

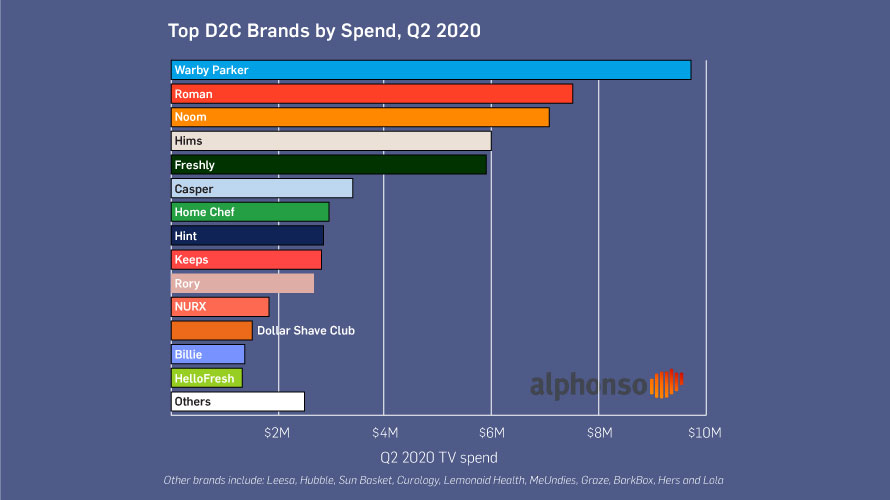

Additional findings from Alphonso, which examined 24 prominent DTC brands that commonly advertise on TV, show that glasses retailer Warby Parker led in ad spend with nearly $10 million in the latest quarter. Erectile dysfunction company Roman followed, with around $7 million, just ahead of Noom, an app that helps people build a healthy relationship with food. The top five brands accounted for more than 60% of total spend.

Cable news networks received the bulk of the brand’s marketing investment.

Although DTC brands are largely built for the current touchless environment where more shoppers buy online, the category has also had its struggles during the pandemic.

DTC clothing retailer Everlane, for instance, cut staff in April, and after a shaky IPO earlier this year, Casper has also announced layoffs. With fewer people traveling these days, luggage brand Away has also let people go as sales dropped.

Join Adweek for Purpose-Driven Marketing, a live virtual event on Sept. 29, to discuss authentic brand purpose and hear insights from top marketers on navigating these uncertain times. Register now.

https://www.adweek.com/brand-marketing/top-dtc-brands-spend-less-on-tv-spots-as-the-pandemic-squeezes-finances/