The past year has been a bruising one for the television industry. Covid-19’s rapid descent on the globe turned off TV’s programming spigots, leading to a drought in advertising revenue. Consumers stuck at home continued to cord-cut or otherwise move over to streaming even faster than they had. And just as a sense of recovery seemed imminent, cases began to surge again: first in the Midwest, and now in almost every state in the U.S., depressing any hope of a quick, V-shaped recovery.

But as we begin 2021, things are starting to look up—sort of.

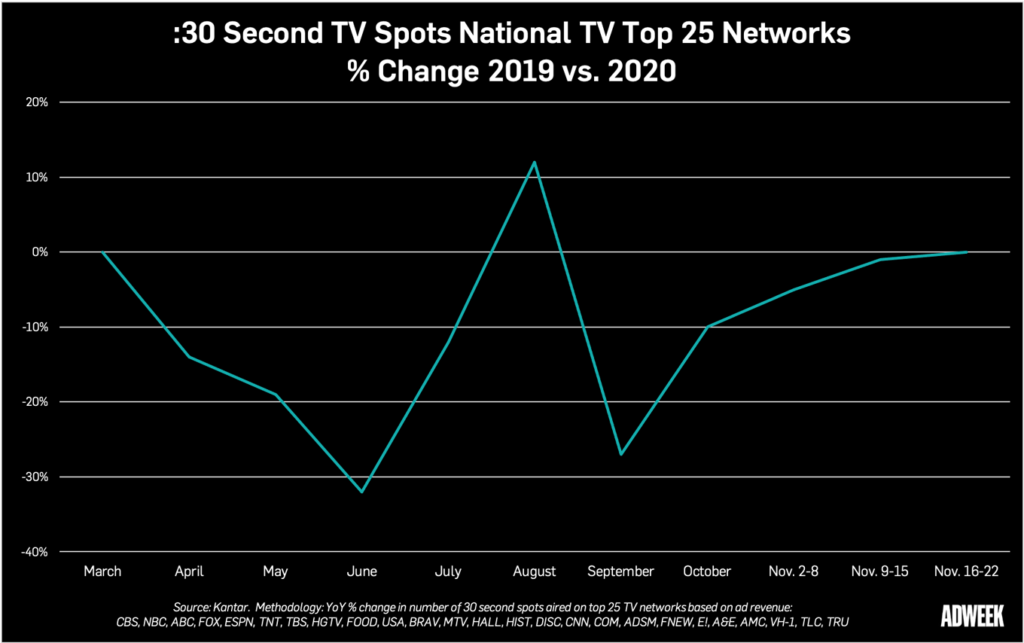

By mid-November, advertising levels across the top 25 TV networks had returned to 2019 levels for the first time since the pandemic began, according to the measurement firm Kantar. That’s one promising sign that advertising spend is finally moving in the right direction for broadcasters. And TV executives at companies like Comcast, Disney and ViacomCBS, which saw steep second-quarter ad revenue drops between a quarter and a third, spent the last months expressing to investors their cautious optimism about a rebound.

“We’re encouraged by what we’re seeing and, big picture, advertising is certainly moving in the right direction,” ViacomCBS CEO Bob Bakish told investors in November, after ad revenue fell only 6% in the third quarter compared to a 27% second-quarter drop. As AT&T CEO John Stankey put it in late October as the company’s ad revenues stabilized: “I think we’re out of the woods at this point, from being dead cold in the middle of the pandemic, to one where we feel like we can get hours [of programming] produced and brought forward.”

The Industry Recalibrates

That optimism remains precarious, however. The notion of a TV ad sales recovery comes hand-in-hand with a a recalibration of industry expectations around what the advertising landscape will look like now that Covid-19 has upended so much about consumer habits and their markedly weaker economic realities. “Recovery is really about how we position ourselves in this new normal,” said Gregory Aston, global head of research, digital advertising intelligence at the intelligence firm Kantar.

There are early signs that TV ad revenue will be more robust in the new year. National TV ad sales are expected to grow 5% in 2021, buoyed by investments around the rescheduled Tokyo Summer Olympics that will bring in an estimated $800 million, according to intelligence firm Magna Global. Because those projections for the TV ad sales landscape hinge on an economic recovery, as well as the assumption that tentpole programming events will continue as scheduled, it’s unsurprising that the industry is anxiously awaiting the roll-out of the incoming Biden administration’s pandemic response, to make early determinations how that will affect consumer and advertiser activity.

“The prerequisite [to recovery] is obviously that Covid is under control in the first half of [next] year,” said Vincent Létang, evp, managing director, Magna Global Market Intelligence. “That doesn’t mean everybody is vaccinated, but enough people need to be vaccinated that the number of cases and hospitalizations go under the threshold that most restrictions to businesses and mobility can be removed in most of the country.”

Where to Spot Signs of Recovery

Vaccinations alone won’t provide the recovery for the TV business’s ad sales. Experts are watching how travel, retail and auto sectors return to television advertising to understand broader trends about consumer confidence and about the health of national TV media spending. Collectively, those three sectors represent around a quarter of total advertising expenditure, according to Kantar. Rising ad dollars in those areas will act as a bellwether by spurring other forms of peripheral economic activity.

https://www.adweek.com/tv-video/tv-ad-revenue-will-rebound-in-2021-but-the-industry-is-never-going-back-to-normal/