Key Insights:

All eyes in the digital media sector are fixed on Google, given the breadth of its online advertising capabilities, but its dominance has also drawn the gaze of regulators who could be weeks away from filing legal action.

The Justice Department and multiple state attorneys general are probing Alphabet-owned Google, which has become the dominant player in the near-$130 billion online advertising industry, according to The Wall Street Journal. The DOJ is expected to file suit this summer at the federal level while states, including Texas, are set to do so in the fall.

Investigations by U.S. justice departments echo similar efforts on the other side of the Atlantic, where the European Commission fined Google 1.49 billion euros ($1.62 billion) for abusive practices related to its search advertising dominance.

In addition to Google’s grip on the search and advertising markets, regulators are reportedly interested in how Google’s ad-tech products impact premium publishers. Several sources familiar with the investigations told Adweek that mounting concerns over Big Tech’s dominance of the media market indicate that intervention is now likely. Although, others cautioned, a seismic breakup could take a significant amount of time.

Investigators looking at possible inherent bias

Jason Kint, CEO of Digital Content Next, the trade group for online publishers, said that Google’s anticompetitive practices hurt more than just individual publishers. “It’s a regular Google narrative that this is a concern of legacy publishers or dying newspapers, or [it’s] European protectionism, and this couldn’t be further from the case,” said Kint, whose trade body represents media companies including The New York Times and NBCUniversal. “It’s actually a concern for the future of the media industry.”

Kint believes that this concern extends to the advertising industry, including advertisers and their agencies.

In 2019, eMarketer estimated that Google brought in 37.2% of total online U.S. ad spend. Facebook, the other half of the so-called “duopoly,” accounted for 22.1%. Google had slipped year-over-year due to Amazon’s encroachment, which took 8.8% of the pie. (The three companies combined made up 68.1% of the market).

Earlier this year, sources told Adweek that DOJ investigators are interested in how Google’s complex ad stack, historically known as DoubleClick, is intertwined with its ad exchange, and whether the algorithms underpinning it contain inherent bias. For instance, questions persist over whether Google’s ad server, commonly known as DFP, favors its ad exchange, AdX, as an inventory supply source for publishers at the expense of third-party supply-side players.

Additionally, Google’s 2015 changes to how third-party ads are served on YouTube, such as restricting access to third-party demand-side platforms, have been the subject of much controversy in recent years.

Some in the industry question if this will lead to Google voluntarily divesting its ad-tech assets, while others suggest that any government intervention will require it to better firewall its various components.

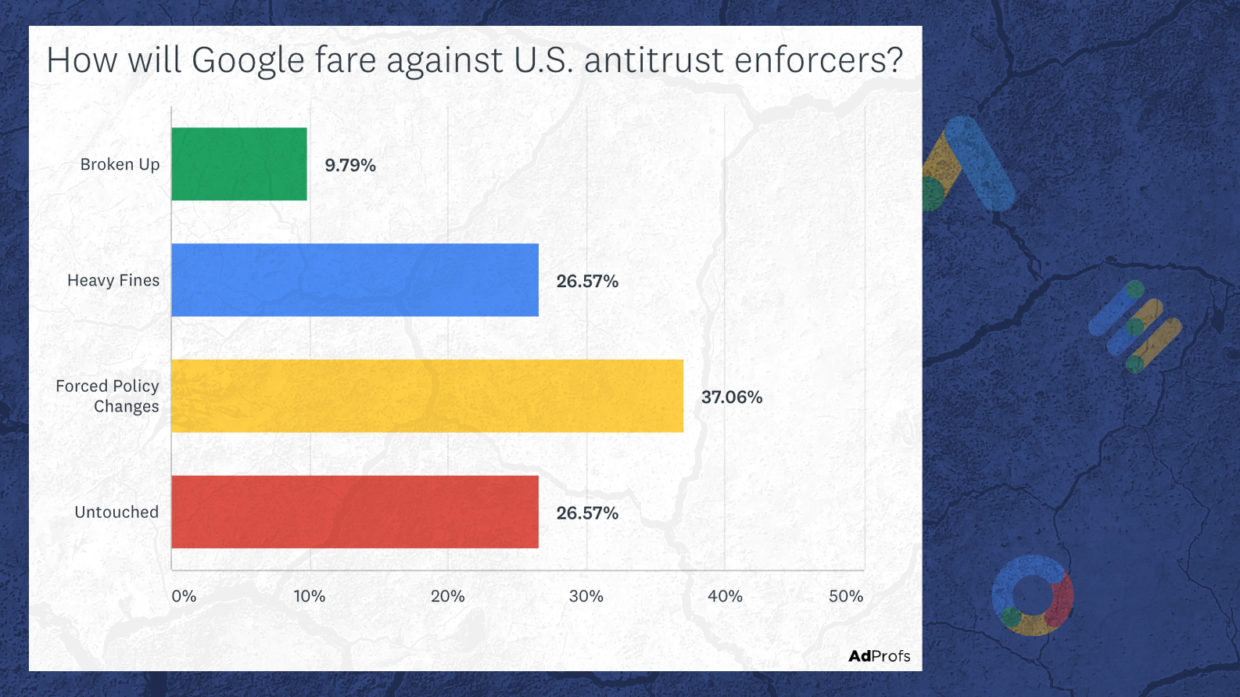

Ratko Vidakovic, founder and principal of ad-tech consultancy AdProfs, said a survey of the company’s membership found interesting splits in opinion on how the federal government will actually crack down on the internet giant, which he said was “anyone’s guess.”

“Judging by our poll’s results, the majority believe that the antitrust process will likely force Google to change its behavior and policies, and possibly incur some heavy fines,” Vidakovic said. “That said, it was fascinating to see how many readers thought Google will escape untouched. That to me seems unlikely.”

Breaking up Google is not the only solution

Ana Milicevic, principal and co-founder at consultancy outfit Sparrow Advisers, told Adweek any potential move forced by the government could be years away. Additionally, she pointed to how regulators elsewhere in the world are counteracting Big Tech’s dominance.

https://www.adweek.com/programmatic/us-antitrust-regulators-are-poised-for-google-crackdown/