As the dust settles on last week’s elections with President-elect Joe Biden set to occupy the White House and Republicans to likely maintain control of the Senate, all industries are contemplating what this political climate will hold in store for them.

Popular opinion remains mixed as to whether President-elect Biden will be more proactive in his policing of Silicon Valley and Big Tech compared to the previous Democratic administration, but most are certain the preexisting Justice Department antitrust case against Google will continue unabated, if not enhanced.

The DOJ’s case against Google focuses on its search apparatus, with the online giant rebutting the charge asserting that “people use Google because they choose to” and not through coercion. Many believe the DOJ’s opening gambit was purposely confined to the consumer-facing elements of Google’s offering, simply because it is easier to demonstrate potential anti-competitive practices in these spheres.

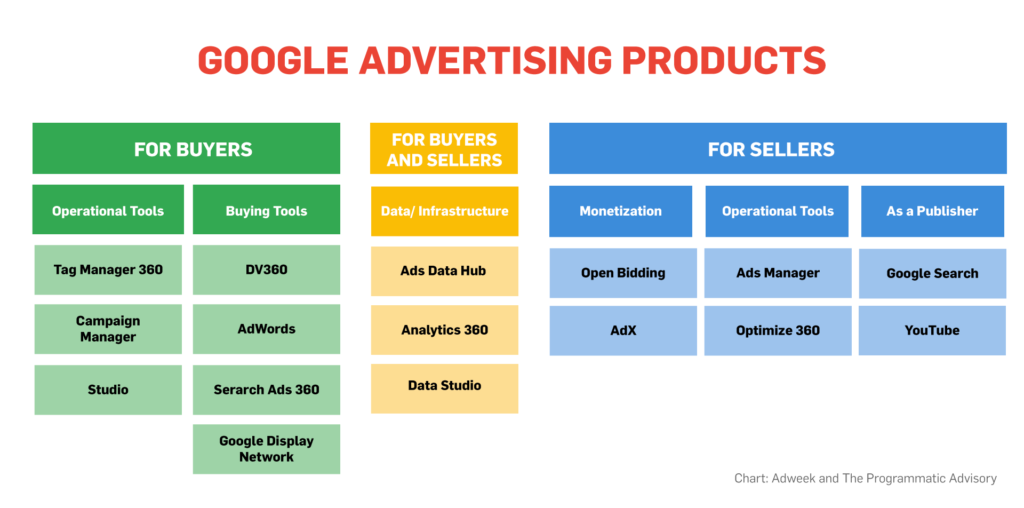

While the incoming Biden administration could potentially amend the existing case, several sources told Adweek state attorneys general, led by Texas’ Ken Paxton, are delving deeper into its display advertising operations. They are specifically exploring allegations that its analytics business and myriad ad stack, popularly known as DoubleClick, are interwoven in a manner that leaves media practitioners little choice.

The tip of the iceberg?

One source with knowledge of antitrust law, who requested anonymity due to their employer’s ongoing negotiations with Google, told Adweek the 11 attorneys general appended their name to the DOJ’s Oct. 20 filing as a means of expediency.

In August, the Wall Street Journal reported differences of opinion between DOJ staff and Attorney General William Barr over the timeline for filing their case with state attorneys general because the attorneys wanted more time to untangle the modus operandi of DoubleClick’s intricate web of tools.

However, by co-signing last month’s suit, any proposed settlement terms now require the state attorneys generals’ consent. They are also free to file their own case, which will likely be under federal antitrust laws as well.

“Once all of them bring their complaints together, those attorneys general can take all of their charges and combine them,” the source said.

From here, legal authorities can merge, or coordinate, these complaints with the preexisting case in the interests of judicial efficiency.

A separate source with knowledge of the developments noted that such filings are imminent. “The really big question is whether or not the next lawsuit is going to address ad tech,” they said. “That’s the $64,000 question.”

What will be in the crosshairs?

Authorities investigating Google’s display advertising have sourced expertise from several consultants in the space with sources indicating that investigators are looking at just how compatible the individual elements of its suite of online advertising tools are with those offered by competitors.

Investigators have also posed questions around the concept of “tying,” such as Google’s 2015 move, which barred third-party demand-side platforms from bidding on ad inventory on its YouTube properties.

There have also been questions around how Google AMP, an initiative to improve the speed of mobile webpage loading times spearheaded by Google, has been designed in a way to thwart the rise of header bidding—a separate industry initiative geared towards reducing publishers’ reliance on the DoubleClick ad stack.

Dina Srinivasan, a fellow with the Thurman Project at Yale University, noted how Google’s dominance in both search and display advertising are interrelated. Google’s power in the search market is not irrelevant to the advertising business, she noted in a recent academic paper.

https://www.adweek.com/programmatic/whats-next-for-antitrust-case-against-google/