Join iconic brands and world-class marketing leaders at Brandweek to unlock powerful insights and impact-driven strategies. Attend in Miami or virtually, Sept. 11–14. Save 50% with early-bird passes.

Direct-to-consumer brands are rethinking their channel strategy, specifically a return to retail, and for a handful of good reasons. While the pivot takes a contrarian stance on the “unavoidable” takeover of online commerce, smart brands are leaning into national retail relationships with a physical and digital footprint.

On the surface, the timing of this shift seems odd. Considering the pandemic’s acceleration of ecommerce sales, many assumed retail revenues would fall off the cataclysmic cliff to certain death. But immediate revenue potential doesn’t always equate to profitability. When considering the burn rate consumer packaged goods brands are experiencing in the DTC model, the proof is in the non-GMO, sustainably packed pudding. There is unavoidable evidence for a CPG brand’s need to pivot.

Within the DTC realm, underlying factors negatively affect the ability of moderately priced CPG and fast-moving consumer goods (FMCG) brands to show black on their profit and loss statements. While we weigh the scale differently for each category, the outcome is predominantly the same. The removal of third-party cookies, the low barrier to entry, and the supply and demand of digital DTC marketing platforms create a challenge for almost every CPG sector.

Whether you’re a new brand challenging a category, an existing brand that transitioned away from retail, or an existing DTC brand looking to pivot for the first time, you’ll need to learn how to navigate the return-to-retail terrain and what it takes to succeed on both physical and digital shelves.

Why pivot to retail?

Retailers are constantly innovating, creating seamless integration between their online and IRL storefronts. This integration presents two primary reasons for getting your hands on the in-store action.

First, your brand can embrace a retailer’s online opportunities. Retailers want brands committed to supporting and performing in-store, in-app and online; pivoting to retail presents opportunities to leverage a retailer’s first-party data for specific consumer targeting. Second, the numbers don’t lie: Projections for 2024 suggest 72% of retail sales will occur offline.

No matter how you slice it, brick-and-mortar stores are still the predominant driver of purchases. Brands willing to buck the DTC-only trend are reaching the largest consumer demographic while establishing deep, sustainable relationships that can lead to future online opportunities.

Why pivot away from DTC?

On the flip side, there are reasons to shift your attention. Whether choosing to promote through organic brand strategies, taking the paid ad approach or a combination of both, the high customer acquisition costs of DTC are not attractive to investors looking for a scalable brand.

There’s also the limitation of DTC reach: With 74% of shoppers making purchases in-store, building mainstream brand awareness exclusively online is nearly impossible. Even successful DTC brands, such as Bulletproof, eventually reach a point where they need partners like Whole Foods to further their growth and meet revenue expectations.

And there’s the false assumption that DTC leads to greater customer loyalty than working with traditional retailers. In fact, the most prominent form of brand loyalty is when the consumer views your products across many digital and physical touch points.

When not to pivot

Not every brand is ready for retail. With retail partnerships comes responsibility. To win in retail, you must have your ducks in a row:

- Supply chain: Do you have the capability to support retail growth consistently?

- Proof of concept: Can you guarantee a good sales velocity to keep your distribution?

- Legal compliance: Are you ready to meet the contractual obligations?

- Capital: Do you have enough funding to support the channel?

- Competition: Within a retail environment with multiple and different competitors, is your brand differentiated and competitive? Do you lose an advantage only available online?

There are plenty of failed examples where a DTC company poorly shifted to retail commerce. While the details differ, the overarching theme is always the same: These brands wrongly assumed their existing awareness and marketing were enough to support these channels.

How to pivot successfully

Retail brands must take a strategic approach, provide product differentiation and have the resources to compete against the big-name, traditional brands that dominate their category. Whether it results from being too ambitious or simply a lack of experience, many brands may fail against existing retail shelf competitors.

Moving from the DTC approach to traditional retail isn’t without risks, but CPG companies can mitigate these risks by addressing four areas.

Establish the right partner(s)

On the other end of the CPG channel spectrum are consumer brands trying to be everything to everyone. As such, these brands approach all physical retail partners for their product category without considering how one affects the other. Having too many retail partners can cause shelf dilution, capital constraints, having too many promotions to manage or losing distribution due to poor product-shopper fit.

Develop a concise value proposition

Being concise in your product messaging is a practice that should exist across all consumer channels, but it’s especially true for in-store presentations. With limited attention spans and competitors sitting within your product’s line of sight, the speed and eloquence with which you communicate your point of differentiation matters.

Customer loyalty is constantly at odds with the retail environment, so engaging in this form of commerce requires more attention to how effectively your packaging design and in-store presentation reach the consumer.

Prepare your supply chain

In DTC, being out of stock may lead to a preorder. In retail, however, it leads to a lost sale.

Supply chain mishaps are risky for your brand and the retailer. Whether direct-to-retailer or through a wholesale channel, overhaul your supply chain to ensure consistent on time in full rates for customer orders so you are a reliable vendor and good partner. Help your buyer ensure you have enough orders in the system to cover any incremental volume coming from a promotion or big event you know is coming up.

Prepare data to support the channel

Assumptions serve no purpose when engaging in commerce with national grocers and retailers. To enter any retail door, you must have consumer data proving why your brand will be a top category performer.

The modern retail store has advanced insights from internal point-of-sale data and eye-tracking technology. Brands mirroring this data-driven intentionality will build stronger relationships with their retail partners.

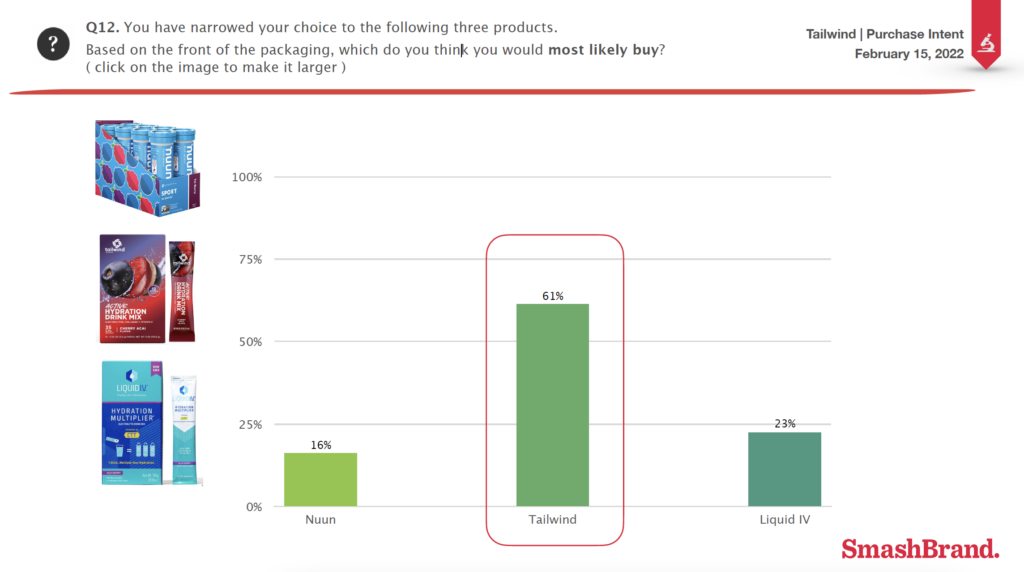

The most predictive consumer data comes through testing buyer behavior in a simulated environment—we call this purchase intent testing, where we separate what consumers say they want from how they make buying decisions while at a retail shelf. This test measures the effectiveness of the packaging and its ability to lead to purchase selection, which commonly happens in 3-12 seconds.

At this stage of the buyer journey, we simulate these choices by inserting your product into a set of leading products you are likely to compete with. We then measure the performance of various packaging design candidates in the marketplace.

The benefits of retail partnerships

Having looked at the why and the how, let’s look at what success looks like after winning in retail. Here are five ways that retail differs from a DTC strategy.

Greater reach and wider brand awareness: Walmart received more than 230 million visits in 2022. Even though this number is down from prior years, 1% of this figure is more visitors than nearly every DTC brand receives to its website.

Access to valuable customer data and analytics: While not every brand asks, retail partners can provide deep insights helping you understand who buys your product and who does not. Collectively, you can better meet the needs of consumers who match your buyer persona.

Opportunities for product innovation and co-branding: Whether through white-label products or cross-brand collaboration, creative co-branding opportunities only happen when you work with the retailer.

Building a loyal customer base through in-store experiences: The more we push to a digital world, the greater consumer desire for a curated retail experience becomes. In-store demonstrations encourage greater brand resonance, so you get two for the price of one in your shopper marketing: direct influence on the in-store sale, plus a broader brand awareness driver, which may halo to other stores and channels.

It opens the door to click-and-mortar: Being on Target.com is not nearly as powerful as being available within their app for in-store pickup. As retailers innovate, click-and-mortar will continue to grow, and you will want to be part of this action.

Ready to transition into retail?

If you are a CPG brand currently using or weighing a DTC model, it may be time to consider a pivot back to retail. These partnerships offer opportunities to reach a larger consumer demographic, establish sustainable relationships and embrace online opportunities. By engaging in retail action, brands can achieve long-term growth and success.

https://www.adweek.com/performance-marketing/why-you-should-pivot-from-dtc-to-retail-and-how-to-do-it-right/