Investors have been in a state of limbo all year long trying to determine if still in a bear market or has the new bull already emerged? 4,200 on the S&P 500 (SPY) being the key level. Interestingly, the Fed announcement on Wednesday 5/3 could be the key catalyst to settle this dispute once and for all. Read on below for the trading plan to stay on the right side of the action. dated market outlook, trading plan and top picks in the commentary below.

Stocks have been rallying to their highest levels since the bear market began…but then took a BIG step back on Tuesday.

Why?

That is going to take a bit of explanation. Gladly we have the time to review it all in this week’s Reitmeister Total Return commentary below…

Market Commentary

Some have oversimplified the Tuesday decline by pointing out that questions have arisen once again in the banking sector. Especially true for the regional banks that fell as a group by 6% on the session.

Most of us suspected there would be more rumblings in this space as so much money has flowed out of smaller banks into the “too big to fail” group. This creates headline risk in the future for the next First Republic or Silicon Valley Bank to emerge. This explains why PacWest and Western Alliance declined -27% and -15% on the day (ouch indeed!).

Now layer on top how every time we turn around, we hit another debt ceiling. Most are easily dispensed with as congress hits the “Easy Button” to push the limit higher.

However, with an election season around the corner it would not be surprising if one of the parties makes a stand to point out the failings of the other. That political brinksmanship is never good for stock prices.

Now let’s put a cherry on top of this Risk Off sundae. No doubt a lot of investors took profits off the table Tuesday given some trepidation coming into Wednesday’s next Fed meeting at 2pm ET.

Right now, there is a 97% expectation of another quarter point rate hike on the way. The divergence in opinion occurs after that. Some expect more hikes and for the Fed to keep those high rates in place til early 2024 (which is the stated plan of the Fed).

Yet amazingly the street consensus is that this is the last rate hike and they will start lowering as early as September. Thus, if Powell sticks to his guns with higher rates for longer mantra, then we will likely see more sell off from the recent peak.

Also not helping the mood is the recent slate of economic reports that show continued weakness. That started Monday with ISM Manufacturing coming in at 47.1 (well below 50 showing that things are contracting). The forward-looking New Orders component was even worse at 45.7.

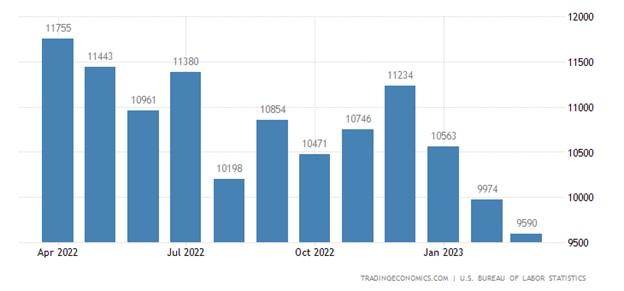

Next came the 3rd straight monthly drop in the JOLTs report (Job Openings and Labor Turnover).

Most investors are aware that employment is the current lynchpin for the economy. As long as that stays strong, then no recession coming putting an end to the bear market. BUT once employment finally weakens, then odds of recession soar with lower stock prices on the way.

Do consider that before companies start firing people, which increases the unemployment rate, they first stop hiring new people. Indeed, that is what the lower JOLTs report may be showing as there are 20% less job openings than a year ago.

Back to the Fed rate decision on Wednesday afternoon. What happens there could serve as the catalyst for the next big stock move.

If they are ready to stop raising rates and hint at the lowering them before the year ends, then stocks will immediately break higher. In fact, it could be enough to lift above 4,200 which would officially mark the start of a new bull market.

That’s because a bull market is designated by a 20% rally from the bear market lows. In that case, we are talking about 3,491 x 20% = 4,189 for the S&P 500 (SPY). Thus, most of us round that off to say a break above 4,200 = new bull market. And we should all get more aggressively long the stock market with Risk On stocks with that break out.

On the other hand, if the Fed sticks to the same hawkish song sheet as the past, then bulls will lose heart with more downside on the way. Remember that Powell has repeated time and time again that they will be keeping high rates in place through the end of 2023.

In fact, at the last press conference he was asked if investors are wrong with their view that rates will be lowered sooner. His reaction was so funny. Like he was the only adult in the room implying “there will be no ice cream before dinner“. Or simply, I could not be any clearer and don’t know why you dopes keep thinking that I am bluffing.

Given that backdrop, I do not believe there is any good reason for the Fed to change course at this time. Which means a hawkish reminder is likely on the way Wednesday afternoon with a sell off more plausible than a break above 4,200.

But anything is possible.

This means we should all stay vigilant for not just the rate hike decision at 2pm ET. But more importantly to get the full weight of their plans in Powells’ comments and press conference to follow at 2:30pm.

The content of these events are likely to provide the catalyst for the next big stock move.

Which direction will it be?

Stay tuned for the answer. But the above gives you a decoder ring of how to interpret these events so you can trade it appropriately.

What To Do Next?

Discover my balanced portfolio approach for uncertain times. The same approach that has vastly outperformed the market since being put into place the start of April.

This strategy was constructed based upon over 40 years of investing experience to appreciate the unique nature of the current market environment.

Right now, it is neither bullish or bearish. Rather it is confused…volatile…uncertain.

Yet, even in this unattractive setting we can still chart a course to outperformance. Just click the link below to start getting on the right side of the action:

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares . Year-to-date, SPY has gained 7.84%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Will the Next Fed Announcement Be Bullish or Bearish? appeared first on StockNews.com

https://www.entrepreneur.com/finance/will-the-next-fed-announcement-be-bullish-or-bearish/450887